|

(Continued on page 1 ) “Just had to laugh! I saw the photograph.” I was watching this fantastic PBS documentary on New York City architecture during the so-called “Gilded Age” – 20yr to 30yr period after the Civil War. The main theme was around Stanford White and his influence on HIGH END buildings in and around New York City. The gist was that the major expansion and growth that occurred after the Civil War fueled major and elaborate Trump type architecture – hence the “Gilded Age”. The REAL 1%ers – JP Morgan, Carnegie, Pierpont, etc. all funded elaborate homes, office buildings, and private clubs. Many of these masterpieces still adorn the New York landscape. What really got me though was the reference on how much “inequality” there was. A VERY small percentage controlled all the wealth while everyone else lived in lower income poverty, struggling from day to day. Coupled with this was a comment: “the equalizing force was electricity”! I guess today they would say: “The equalizing force is the Internet.” All in all a fascinating look at the past OR do I mean the present? “Back to the Future.” ______________________________________________ apppro’s take for 05/19/2016 07:30 am EST Kicking that Fed Box – the cat has NO chance! Almost exactly 3 years to the day after Bernanke’s initial “Taper Tantrum” and when I wrote” Schrödinger's Cat—Looking inside the Fed’s Box!” on 05/15/2013 page 8, yesterday we got a quickie “Hissy Fit” over Fed Minutes that mellowed out by end of day. Things are looking somewhat non eventful this morning (Pajama traders took too much Ambient last night I guess.), but we still have Cramer to deal with in 2 hours and he can scream and rant about a stupid .25 basis point raise; and well that could throw everything into a true tantrum. Hey Cramer, “YOU KNOW NOTHING!” Also, try to remember that all those same talking head pundits that screamed back then that the Fed was nuts to raise, are NOW saying over and over: “They should have raised back then when they had the chance, now its too late!” Self-serving hindsight is a wonderful thing, isn't it! I’m not living in some kind of “Secret Lives of the Ultra Rich” hole! I know things are not that great out there Now this morning we have Forex traders going nuts and this is killing the recovery for oil and other commodities. But mainly what we have is a media, mainly CNBC, that keeps pushing the fear mongering and volatility. Pundits and so-called “contributors” will come on their programs all day long spewing their fear and every time they do – HFT seeker bots hear the keywords and BAM – Mini Flash! All this self-created volatility just so option traders can make a quick 300% gain on something that contributes NOTHING to the REAL economy is INSANTY! Note some of my tax proposals will help cut back on all this useless gambling which is NOT Main St helpful. Since 2009 I kept asking in relation to the volatility and misery of crashing markets: “What have we learned?” You may remember that my answer then and NOW remains the same: Nothing! Squat! Zip! Zero! Not a damn thing! ______________________________________________ apppro’s take for 05/17/2016 02:30 pm EST And the “HISSY FIT” starts! I guess that hissy fit I mentioned earlier just started over these Fed comments:

You can reference them clearer on TradersCommunity

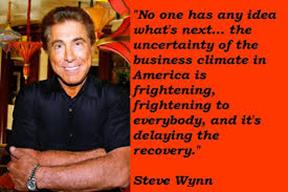

______________________________________________ apppro’s take for 05/17/2016 10:00 am EST The MOST critical comment on rates yet! Amoroso: We see opportunity in banks (Towards end of video) It’s not the 10 year rate that everyone keeps stressing over as to whether banks can make money or even the almighty NIM (Net Interest Margin); but rather it’s the short term rates—mainly the 2yr that determine most loans. This is why small rate increases even with a narrowing yield curve are OK for the banks and GOOD FOR THE ECONOMY!! Remember, you can’t force people to borrow! Two—1/4 point raises this year should not derail anything, actually they will show the economy really is stable enough to normalize. “IF” (and that’s only an “IF” if we allow that “IF”) a few bond hedgies and HFT quant algo’s want to throw a hissy fit like they did in January; well all I can say is: “Screw us all once, shame on you! Screw us all twice, shame on ALL of us!” ______________________________________________ apppro’s take for 05/08/2016 05:00 pm EST Predatory #HFT Algorithmic Trading A few have asked me what I mean by “predatory” HFT trading. There is a HUGE difference between the Flash Boys HFT trading and “directed and predatory” algorithms. Best way to explain it is just watch this: Predatory HFT Algorithmic Trading This is really an add-on to below! _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ apppro’s take for 05/07/2016 05:00 pm EST OK, ENOUGH IS ENOUGH! Even Steve Wynn has had enough! For well over 7 years I have been screaming and yelling about the total disgrace of our markets. From: · Predatory #HFT Trading, to · Naked Short Selling, to · NO uptick Rule, to · The gambling, to · The short term thinking & INSANITY, to · Etc., etc., etc. that the last 2 Administration’s SEC has created in OUR markets. Come on people when are we going to end this? 7 years of mediocre growth that can be directly tied back to the SHORT-term mentality and gambling of the financial markets hasn’t pissed enough of you off to say, “ENOUGH ALREADY”! OK, I understand I’m a nobody, but many others are screaming too! Here’s Steve Wynn’s last tirade, and one thing is for sure – he’s NOT a nobody!

Steve Wynn lashes out on ‘unconscionable manipulation’ in the stock market And if Steve’s focusing in on what is CAUSING the insanity is not enough, try some screaming from Mark Cuban: Mark Cuban takes his grudge against the SEC to the Supreme Court Look, I realize that many out there think all this short-term thinking and gambling is good for capitalism, BUT come on people – how much of this kind of crapolla do we really need to enable. Even Dan Nathan on that most deplorable CNBC program “Options Action” (video not available) referenced Steve Wynn above saying, “Even Steve Wynn would consider us Devil incarnate!” DAMN RIGHT! I’m not asking for much, the “7 Golden Rules” would be great, BUT how about just some fairness. And let’s not forget to consider my 65% WindFall Capital gains tax for shorts. Everyone criticizes China on how they treat short sellers and out of control ANALysts & media – HEY our daily Flash Crashes and volatility are something to cheer about???? ______________________________________________ apppro’s take for 04/15/2016 08:00 am EST The Interview that EVERYONE needs to watch! Too big to fail not our biggest issue: Fed's Kaplan

I again want to remind everyone what I’ve said since 2010: apppro’s take for 09/29/2010 @ 06:00 pm EST “Clueless in Seattle” We just don’t’ seem to get it! The “Nation of Bash & Blame” keeps putting out crapolla just so they can extort monies out of our banking system. Once and for all, OUR banks did not cause this mess. The failed institutions were NOT banks. Our BIG banks saved our collective butts and were NOT the cause of the crisis. Ambac Insurance was NOT a bank! MBIA was NOT a bank! Analy Capital was NOT a bank! Bear Stearns was NOT a bank! WAMU was NOT a big bank and a BIG bank bought them out! Lehman’s, the granddaddy of them all was NOT a bank! AIG was NOT a bank! Merrill Lynch was and is NOT a bank! And even GM was NOT a bank! FinReg is and will continue to be a total disaster based on hatred and payback!

And please don’t forget what Barney Frank said many times:

DJ Rep. Frank: J.P. Morgan Shouldn't be Prosecuted Mon Oct 22 17:50:19 2012 EDT

Rep. Barney Frank (D., Mass.), the co-author of the Dodd-Frank Act, on Monday issued a statement saying prosecutors shouldn't go after J.P. Morgan Chase (JPM) over infractions committed by Bear Stearns, which it purchased during the credit crisis. "Having been Chairman of the House Financial Services Committee at the time that this occurred, I know that J.P. Morgan Chase acted at the strong request of the Federal Reserve and the Secretary of the Treasury during the Bush administration. The federal officials involved believed that the failure of Bear Stearns would have terribly negative consequences for the economy, and they urged J.P. Morgan Chase to do a good deed by taking over an institution which, I believe, the bank would never have sought to acquire absent that urging. The decision now to prosecute J.P. Morgan Chase because of activities undertaken by Bear Stearns before the takeover unfortunately fits the description of allowing no good deed to go unpunished," he said, adding prosecutors should go after individuals instead. A similar rationale applies to Bank of America (BAC) over its purchase of Merrill Lynch, Mr. Frank said (Continued from page 3) |

|

The Stock Room page 2 |