|

The Stock Room page 9 |

|

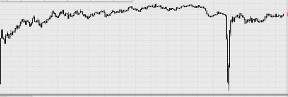

(Continued from page 8) "I expect to hear from a host of people who will say, 'how does the Fed end this nonsense,' and they will either be short this stock market or have very little invested and need it go lower." “DON’T BELIEVE THEM!” Why the heck we have allowed these SHORT-term option crazies to control us all is still the real question. Yes, there may have been a brief period of time where all the trading of these SHORT-term vehicles served a purchase. Farmers used option hedges for corn or drillers used option hedges for oil, BUT now 90% of what is going on is daily and ‘weekly’ gambling using options that serve NO purpose except to allow a few to gamble on all the rest of us! ENOUGH! Their gambling does nothing to promote growth or jobs. It truly serves NO purpose and the proceeds NEVER go back to the companies or industries that it originally was meant to serve. Now they have attached HFT algo’s to this and what happened in the past week is just another example of the insanity we have allowed.

And while that AP Flash Crash only happens once in a while, the daily closing insanity at 3:50 pm happens on… well, almost a daily basis.

We need to stop this! This market is sitting on pins & needles because the media has driven us all nuts, and if we don’t stop it then as I said in 2007… “This will all end very badly!” Lehman’s3 STOP the INSANITY NOW! _______________________________________ apppro’s take for 04/23/2013 03:30 pm EST AP Tweet Flash Crash Damn it people… I TOLD YOU SO & I TOLD YOU SO & I TOLD YOU SO AGAIN!

It’s bad enough that HFT scum uses those “vacuuming algo’s” to crash the markets on actual news, NOW we even have to deal with it when the news is totally bogus.

When are we going to learn? PULL THE DAMN PLUG NOW! _______________________________________ apppro’s take for 04/10/2013 04:00 pm EST Dodd-Frank 'Written in Anger,' Needs Fixing: U.S. Chamber of Commerce CEO _______________________________________ apppro’s take for 04/07/2013 09:00 am EST “Eve of Destruction” - 3 steps back followed by 1 huge leap back!

On the eve of: Tens of thousands Obamacare 'navigators' to be hired – Obama’s new Acorn! & Obama budget to take aim at wealthy IRAs – Obama’s take on Cypress! & New type of subprime loan pushed – Washington’s attempt to accumulate new failed loans to sue the banks over again in 5 years!

After all of this we get: A bipartisan Senate bill would force all banks to hold capital of 10% and those with over $400B... – Washington’s attempt to further castrate our financial system, all because they have their _______________________________________ apppro’s take for 04/01/2013 06:00 pm EST Shades of Grey! Whale grey that is! Shhhh! Wall Street Whispers Revealed Mon, 1 Apr '13 | 8:30 AM ET Financial Web site SumZero provides a place for analysts, hedge funds and private equity firms to share under the radar investment ideas. Divya Narendra, founder & CEO of SumZero, explains. Now isn’t what this guy is selling exactly what I said some were doing to JPM’s infamous ‘Whale”? Back in July I wrote: apppro’s take for 07/14/2012 11:30 am EST The Whale’s Ahab: Mark-to-Market Strikes Again!

This is what happened to JPM’s Whale trades and the current discussion of “intent”. JPMorgan Claim of Possible Trader Intent May Help Bank - Bloomberg For the most part we ONLY had 2 parties trying to create a value of the Whale’s purchases. 1. The Whale himself who OF COURSE is going to value his purchases at nearly full value. These were LONG-term items and therefore it was his “intent” that in 10 20 30 years they should be worth close to, if not at their full value. 2. And the SHORTS whose ONLY “intent” was to drive the value down as close to $0.00 as possible so they could cover. That’s it… those are the ONLY 2 parties involved; so when it came time to employ that dreadful M2M whose value do you accept? I could just imagine what the conversation was in the dungeons of the shorts who were trying to destroy the Whale: “Hey guys, sooner or later the Whale is going to have to use that joke of an accounting rule M2M. All we need to do is keep shorting it and shorting it until we can rumormonger everyone into believing the value is 50% less. There are NO other parties willing to or thinking about buying the Whale’s purchases, so he will be forced to M2M the value at 50%... and WHOOPS there it is… we make a killing!” _ _ _ _ _ Isn’t the last paragraph exactly the blatant hedge fund manipulation that the above guy is selling? Come on SEC – and Senators – what the hell are we doing here??? And everyone don’t forget: “Kavi Gupta, a credit derivatives trader at Bank of America Merrill Lynch, wrote in an April 10 note to clients that it was time to take advantage of the index moves. “What better opportunity than Easter Thursday with Europe cratering to annihilate people,” he wrote. A BofA spokeswoman declined to comment. Since then, traders say, an increasing number of hedge funds and some asset managers have placed more bearish bets, taking opposite positions to J.P. Morgan and possibly hurting its ability to pare its positions.” What I found especially offensive was when someone on CNBS sort of questioned him on the obvious manipulative nature of his service, and the SumZero CEO said that have very strict disclosures and “it is the hedge fund member’s responsibility to act RESPONSIBLE!” Totally reminded me of: “I was only following orders!” OR more appropriately of Sargent Shultz: “I know nothing! I see nothing!” Stop blaming the damn banks and go after the real criminals! _______________________________________ apppro’s take for 03/29/2013 10:00 am EST “Clueless in Seattle” again on the 4th year anniversary of the Great Recession Crash! Well, here we are: almost 4 years to the day of that ‘generational low’ in the markets due to what some called the “Great Recession”.

Unfortunately, that ‘Great Recession’ really didn’t happen till AFTER the selloff started, not before – chicken and the egg. Plus we all should take note that what took decades to build and 4 years to regain, we allowed to be destroyed in as little as 3 months. I’ve talked about both of these subjects many times before and still I seem to be talking to the Back in the 1920’s, just before the Crash of 1929 who and how were people trading stocks? For the most part people traded actual stock certificates on a face to face basis. There were no computers, maybe just a ticker price that was rarely timely, anyway. It was more of a 1 on 1 situation. This was especially true for the few short sellers out there. Back then they actually had to TAKE DELIVERY of the actual stock certificate to prove they had borrowed the shares thus preventing naked short selling. All of this did NOT prevent the crash, just slowed things down for a while because short sellers could still bang away at a stock with impunity. Not until after the crash did the regulators institute the Uptick Rule which helped to control violent downdrafts. Now we have computers doing in a matter of nano seconds what might have taken days/weeks to accomplish. Plus we got rid of the uptick rule in July 2007 – no coincidence that the market insanity began about then too! Whatever! So now we find ourselves back to a market level eerily reminiscent to that 2007 level & in reality with LESS controls & MORE volatility & uncertainty then existed in 1929. So now what? Anyway, back to what I wanted to talk about. Ever since the crisis began we’ve blamed our banks over and over for the ENTIRE mess. We have spent years and millions/billions of dollars trying to figure out ways to destroy our banks and to extort moneys out of them in order to bailout a defunct political establishment. I have always acknowledged that many so-called ‘big banks’ were not innocents in the mess. They made suspect loans to people that should NEVER have gotten them. Short cuts were taken and faulty SOP procedures were followed. Yes, the banks were not innocents; BUT NETHER WERE ANY OF THE REST OF US because this is what WE ALL WANTED! In 2007 it all started to unravel. All those TV commercials telling everyone to get loans and buy homes they couldn’t afford just couldn’t keep it afloat anyone. What we had was a group of individuals actively coming up with schemes that were meant to destroy that and to destroy the financial institutions that had promoted the housing irrational exuberance. Shorting scheme after shorting scheme arose, and the Bush SEC had given those hedge funds a clear and unrestricted path to do whatever they wanted. It became a free-for-all and while we say Wall St – it was more like Greenwich, Conn! What followed in 2008 was a series of short seller’s scheme after another with no attempt to leave anything behind. ‘Creative destruction’ was thrown out the window for just plain ole ‘DESTRUCTION’. Vast fortunes by a select group of hedge fund managers were made. That 1% was really more like .0001%! Millions lost their jobs and millions worldwide have suffered! But what did we do? We came up with moronic regulations to punish the easy targets, while at the same time we had these short sellers come to Washington to get a pat on the back for a job well done.

Now today, we have State AG’s and the DOJ and lawyers worldwide trying to figure out one extortion scheme after another on how to screw over the now infamous TBTF banks. Day after day 1 moronic lawsuit after another has arisen. The ONLY profession that hasn’t had a decline is the legal. We still have NOT realized that as I said in 2010… The institutions that failed were NOT banks. apppro’s take for 09/29/2010 @ 06:00 pm EST: page 51 “Clueless in Seattle” We just don’t’ seem to get it! The “Nation of Bash & Blame” keeps putting out crapolla just so they can extort monies out of our banking system. Once and for all, OUR banks did not cause this mess. The failed institutions were NOT banks. Our BIG banks saved our collective butts and were NOT the cause of the crisis. Ambac Insurance was NOT a bank! MBIA was NOT a bank! Analy Capital was NOT a bank! Bear Stearns was NOT a bank! WAMU was NOT a big bank and a BIG bank bought them out! Lehman’s, the granddaddy of them all was NOT a bank! AIG was NOT a bank! (Continued on page 10) |