|

The Stock Room page 51

|

|

(Continued from page 50) looking to install a radical Islamic government. I can only pray that our current President isn’t as naive as President Carter was back then. Not looking too good is it? _______________________________________ apppro’s take for 01/29/2011 @ 011:00 am EST: Tweet This!

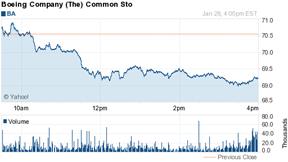

I’m sure many of you have been watching in horror the mess in Egypt. What a disgrace, all the way around and on everyone’s part! Imagine! I am also sure you all have seen just HOW these people have been coordinating and spreading the fear and angst. Yeah you got it, via Twitter and Face Book. Daily Show Explains Egypt Riots: Blame Bush, Obama And Twitter! (VIDEO) | TPM LiveWire Several months ago I warned everyone about how this could possibly happen, but my warnings were about some morons & twits from CNBS’s Fast Money tweeting their short trades causing mayhem in our financial markets. Maybe that’s what happened yesterday causing a 160 point drop! This I don’t know. All I do know is that sometimes, especially in today’s connected world, “ignorance should be bliss”, but even I didn’t see Cairo coming! If we just look at 2 charts, one for the S&P 500 (^GSPC) and one for Boeing (BA), what we do see is that neither of these 2 sold off before the market opened when the riots were already ongoing. Furthermore, there had been riots all week long, so why now?

Someone really needs to pull the plug on ALL these ridiculous ‘15-minute’ enablers once and for all! _______________________________________ apppro’s take for 01/28/2011 @ 07:00 am EST:

Even this guy has been able to get off of his all-fours and stand tall! Why can’t we? Have you seen the latest bs on what caused the financial crisis? Financial Crisis Inquiry Commission's report released | Washington Business Journal Makes really great potty reading, because the conclusions are again worth %!&%! Come on America… get off your knees and scream to: STOP THE INSANITY NOW! The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. __________________________________________________ apppro’s take for 01/22/2011 @ 09:00 am EST:

A Good Start? Obama says opening markets key to jobs - Yahoo! Finance WRONG! Oh sure, getting China and others to stop manipulating their currency and conspiring within their own borders to restrict/hamper/steal overseas companies & technology from doing business… well sure that would help, BUT again it’s not the answer to creating or promoting jobs here within our OWN borders. We are listening to a bunch of nega-pundits who MOVED ALL their assets and themselves out of this country, and now live elsewhere while they preach to us on how we are doing things wrong. Fine, let them go. Actually in many cases – good riddance; but to allow them to preach to us all the while they keep trying to destroy us through naked shorting… well that really makes me puke. You want to know what makes me mad… Back to Obama! At least he seems to be trying, but I’m sorry Mr. Prez – YOU’RE STILL MISSING THE POINT! Things might be getting better, but we can thank the Fed, and maybe my constant bitching for bursting the ‘bloated Treasury’ bubble and now finally it appears that the horrid ‘useless gold’ bubble is beginning to pop, too. This has freed up assets that can now be employed to building bridges and creating jobs. Thank you Mr. Bernanke! Now Mr. Prez YOU must redirect the National Psyche towards LONG-TERM INVESTING and NOT gambling on Wall St. – the true cause of our current misery. We are still allowing those short-term option traders/traitors to manipulate our emotions thru gullible media so-called reporters in order to trade their positions and create “irrational exuberance” on Tuesday, only to destroy it through “unusual uncertainty” by Thursday. And please don’t forget about the horrid ‘Whitless Effect’ that I wrote about last week… is nothing sacred? The ‘Trader/Traitor Decade’ MUST END Mr. Prez, so use your bully-pulpit to call to: STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years - 5% tax on capital gains 2. Capital gains 2 > 5 years - 15% tax on capital gain 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund.

The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________ apppro’s take for 01/15/2011 @ 01:00 pm EST: Very, Very Conflicted!

I am truly glad that a few of the purveyors of destruction are finally getting their due "Instant Karna is going to get you!", but in the process the rest of us are really the ones getting the screwing. Firstly the cast of characters:

And finally:

Now for a quick idea of the subject: Municipal bonds. After local and State taxes, muni bonds are how local governments pay the bills and get money for infrastructure improvement. People and large financial institutions, like Pimco, buy these bonds… collect the interest the bonds generate… sometimes resell them to others… and basically help fund yours and mine local police and firemen. Noble cause… right? Absolutely!

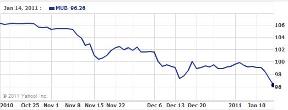

Just to show you the damage being done, please look at this 3-month chart of the MUB which is an ETF that tracks the value of a large group of muni bonds. Since Whitless started her bashing these bonds have lost close to 20% of their value. As the MUB goes, so goes the value of everyone’s local bonds and the solvency of our local & State institutions. In other words, the worse this chart looks, the worse off we all become!

Thank you very much Meredith! This chart shows that over the last 3 months the value of EVERYONE’S local muni bonds have fallen off a cliff and this calls into question the ability of EVERY municipality nationwide to PAY THEIR BILLS! So why has this happened? Well, in 2 words… MEREDITH WHITLESS! Her driving need to regain her ’15-minutes’ has caused everyone to call into question these bonds and local governments’ ability to make the interest payments & pay their bills. I am sure that there are many localities across the U.S. in tight restraints due to this short-seller forced recession. We are now all paying for what I screamed about 3 years ago – Bill Ackman’s takedown of the insurers of these very same muni bonds… what started the whole mess in October ’07. Now Whitless is rumor-boarding all these bonds causing a Lehman like run on the banks so to speak, but this time it’s in muni bonds. There are few out there that agree with her, but people are so scared now a days from what Pimco did to Europe’s bonds, that people sell first and don’t ask questions later. Meredith Whitney Overreaches With Muni Meltdown Call: Joe Mysak - BusinessWeek

Bill Gross and Mohammed of Pimco who own a LOT of these muni’s, tried their best to pooh-pooh Whitless’ analysis; but in today’s media driven ‘YouTube Nation’ the one with the most horrific claims are the ones that everyone listens to. The damage is done! Payback is a bitch, isn’t it boys!

So exactly what damage has been done? (Continued on page 52) |