|

The Stock Room page 68

|

|

(Continued from page 67) 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. _______________________________________ apppro’s take for 02/10/2010 @6:00 pm EST:

Sort of got snowed out from going to work today. I should have gone, because all I did was to sit home and aggravate myself over the horrid negativity and bashing from those horrid CNBS programs. Why do I do this to myself – I’m not really a masochist, or am I? Right now I flipped on those jerks on CNBS’s FastAsswipes, and immediately I’m bombarded with TRADE everything… be nimble… get in - get out… short this – short that. OK, that’s what the show is about – WELL THEN PULL THAT POS OFF THE AIR!!!!!!!!!!!!!!! How did we come to this? When did we allow so few to dictate how so many should survive? Those horrid short-term option traders are going to kill off any recovery we might be experiencing from the cliff that they helped push us off last year. When does it stop? One thing is for sure: there will be NO long lasting recovery until we get small businesses back into the boat again, and start to help paddle. Right now, anyone who was even thinking of starting up a new business is just sitting there… waiting! You’d have to be out of your mind to borrow money, put your entire livelihood & family at risk in order to start up a business no matter how great it might be when >>> everyday someone is bashing you over your head telling you that tomorrow everything is going to fail! Why bother! Doesn’t Main St. see how much damage these traders/traitors, AND NOT THE BANKS, are doing to all of us? Obama wants to tax the banks and get our money back! That’s smart - NOT! Go and tax the very money OUT of the banks that you want them to loan out? BESIDES that’s not the MAIN issue, because the general consensus is that few even want to borrow the money in the 1st place. Can you blame them? Tax the people causing all this angst and please don’t forget that at the same time give MORE tax relief for those committing to long-term investments.

STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains under <6 months - 55% tax on capital gains 2. Capital gains 6 > 12 months - 45% tax on capital gains 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. The 4 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales! Build… Build… Build! Drill… Drill… Drill! Jobs… Jobs… Jobs! _______________________________________ apppro’s take for 02/09/2010 @7:00 pm EST:

‘Bubble, Bubble Toil and Trouble’

Boy would Shakespeare turn over in his grave if he knew how we have all destroyed those great lines from his Macbeth, Double, Double Toil and Trouble - Shakespeare “Double, double toil and trouble; Fire burn, and caldron bubble.” But that is exactly what we have done, knowingly or not! What is a bubble? There are many web sites you can go to, but for the sake of expediency let me quote Wikipedia: Stock market bubble - Wikipedia “A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.” Simply put it is when many try to buy and obtain objects that a few had inflated the prices of, either through hype or sheer product price manipulation. Here – greed greatly overwhelms any fear and reason. Over the centuries we have ALL created many of these ‘bubbles’. “Tulip mania or tulipomania (Dutch names include: tulpenmanie, tulpomanie, tulpenwoede, tulpengekte and bollengekte) was a period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinarily high levels and then suddenly collapsed.[2] At the peak of tulip mania in February 1637, tulip contracts sold for more than 10 times the annual income of a skilled craftsman. It is generally considered the first recorded speculative bubble (or economic bubble).[3] The term "tulip mania" is now often used metaphorically to refer to any large economic bubble (when asset prices deviate from intrinsic values).[4]” “The "dot-com bubble" (or sometimes the "I.T. bubble"[1]) was a speculative bubble covering roughly 1998–2000 (with a climax on March 10, 2000 with the NASDAQ peaking at 5132.52) during which stock markets in industrialized nations saw their equity value rise rapidly from growth in the more recent Internet sector and related fields. While the latter part was a boom and bust cycle, the Internet boom sometimes is meant to refer to the steady commercial growth of the Internet with the advent of the world wide web as exemplified by the first release of the Mosaic web browser in 1993 and continuing through the 1990s.” “A real estate bubble or property bubble (or housing bubble for residential markets) is a type of economic bubble that occurs periodically in local or global real estate markets. It is characterized by rapid increases in valuations of real property such as housing until they reach unsustainable levels relative to incomes and other economic elements, followed by a reduction in price levels. Whether real estate bubbles can or should be identified or prevented, and whether they have broader macroeconomic importance or not are debated within and between different schools of economic thought, as detailed below. Some argue that the financial crisis of 2007–2010 was at least partially due to real estate bubbles, notably in the United States.” All bubbles have one thing in common…. sooner of later they all BURST! Normally what happens is that a few get suckered in towards the end and inevitably get wiped out. You all can remember the ‘dot.com bubble’. After that bubble popped in 2000 many saw their fortunes wiped out, BUT there was really NO long-term effect on Main St. Actually bubbles of the past created a lot of great companies that survived the insanity, i.e. Cisco, Apple, Microsoft to name a few. Whether you want to admit it or not, the recent housing bubble would not have been such a bust for so many if we had NOT destroyed most of our financial system at the same time. Things never had to get as bad as they did, but the people who bust the recent ‘housing bubble’ were not content with their ill gotten gains. They wanted/needed more, so they brought down Bear Sterns, then WAMU, then Lehman’s, and then the biggest of all AIG! All this destruction finally spilled over onto Main St. causing what many have called ‘The Great Recession’. It just didn’t have to happen the way it did. It just didn’t! This time after the bubble was burst, MANY ARE SUFFERING!!!!!!!!!! What still amazes me is that no one asks WHY? Why do these bubbles burst, and more importantly who is holding the pin shoving it in deeper and deeper and deeper? That answer is actually quite easy. In the stock market there is always someone selling something and someone else buying it. HOWEVER, there is a 3rd party who stays hidden behind a wall of secrecy and deception betting that everything will fail, and don’t get that word wrong… betting is the operative word here, because that’s exactly what they are doing. So who are these people? They are what many refer to as ‘short sellers’. I don’t want to get into a long discussion on how they operate; suffice it to say that they are gambling on things failing. This time however we have created a far more insidious bubble: ‘The Trader/Traitor Bubble’. Over the past 10 years technology and poor SEC enforcement has allowed a short-term mentality to prosper in our markets. These short-term traders/traitors are using the option markets simply to gamble in one financial sector and then another. There is NO investment in machines! There is NO investment in houses! There is NO investment in people! There is NO investment in anything for that matter, except paper trades. Actually there aren’t even paper trades anymore – just bits of information moving on the invisible Internet highway. All the effort, time, manpower, AND money that might have been used to build a bridge or hire 500 people is being put to work making nothing except paper trades for a select few. Please, don’t start screaming it’s the banks, either – ITS NOT! While these traders/traitors move what precious assets are left from one computer screen to another – the rest of us can only sit idly by waiting for their ‘next shoe to drop’! You should all remember that these traders/traitors are also NOT paying any real taxes on these gains, or the taxes being paid are capital gains and far less then regular tax rates on incomes. This time when the bubble bursts NOTHING will be left behind to build on. We are shorting ourselves with all this negativity into a 2nd Armageddon II that no one, especially Main St. will survive. Our media has also created more hysteria then needed, all for sake of their ratings. We all must stop looking for ways to destroy our financial system and to get people into investing long-term in our economy & Nation. This has become all the more important when we take into consideration what has been going on over the past month in our markets.

STOP THE INSANITY NOW!

Revised Tax Rules:

1. Capital gains under <6 months - 55% tax on capital gains 2. Capital gains 6 > 12 months - 45% tax on capital gains 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. _______________________________________ apppro’s take for 02/06/2010 @9:00 am EST:

There really is just NO reason for this:

Yesterday, we got very close to going back over the edge, just like last year at this time. If we don’t stop the media negativity and rumor-boarding we will not recover from this new call for Armageddon II. So why did we sell off like this? Answer… Stupidity! Reality… naked shorting and NO uptick rule! Forget about the bs that the European continent is about to default on every loan and will stop paying their bills. Do any of you REALLY think that will happen? It is just like the Dubai blip a few weeks ago, and NOTHING happened there either. Shorts have no reason to bash and kill our own banks directly anymore, so now they’re trying to dismantle the entire World’s financial system as a back door into covering their short positions. Despicable! But what’s worse is that the rest of us just sit here and like last year at this time, we’re allowing these guys to shove it up our collective asses all over again! Screw us over once, shame on you! Screw us over twice, shame on US! BIGTIME! And we allow our so-called media heroes to feed right into all this negativity and hysteria. Yesterday, after announcing some fantastic earnings, John Chambers of Cisco was just pummeled by Erin Barfnett of CNBS.

Over and over and over again she kept bullying him into saying things suck and why is he so optimistic? Being the gentleman he is, he just politely said to Erin that things ARE BETTER! I’m not as much of a gentleman so I can say, “Hey Erin – SHUT the !%#* UP!” For those true ‘conspiracy theorists’, there is also the hypothesis that China is using State funded short sellers like their Jimmy Rogers, to spread this angst and to short the West’s financial system into oblivion. Supposedly this is payback for our rearming of Taiwan and for OUR consistent and unwarranted bashing of the Chinese economy.

The 4 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales! Build… Build… Build! Drill… Drill… Drill! Jobs… Jobs… Jobs!

Added side note: After I posted this blog, I came across this article on SA. WOW! A little scary when you take it into context with The Chinese Connection I proposed above! JPM's Dimon on the Soundness of China's Banks _______________________________________ apppro’s take for 01/30/2010 @7:30 am EST:

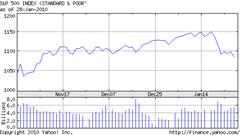

I think these 3 charts of the 3 major indices says it all. In just 1 week we have again allowed a few to destroy the future of the many. OK, Main St. doesn’t give a hoot – you will when you can’t get that loan or can’t get that job. I’ve said this before, but since we’ve been having a relatively calm, upward trend in all markets, up to last week that is, everyone on Main St. was busy watching the economy grow at 5.7% and didn’t care what the markets did. But NOW “The Shorting of America” is back, and all the bs that it’s China or Greece or Bernanke or Obama or even that needed/much anticipated/so-called correction is just that >>> BS! Don’t forget that the very same shorts calling for this kind of correction are ALSO the very same ones calling for a far more drastic one. Their greed can never be satisfied! If we don’t do something quick about this ongoing short-term option trader/traitor mentality… well those charts will have a _______________________________________ apppro’s take for 01/29/2010 @7:30 am EST:

narrator of Stock Shock fame sent me an email about CNBS & their role in the near death-knell of Sirius Radio. I have to totally agree with him, but the email was a little too much of a promotion for me to post. This blog is not a democracy. However, I strongly urge everyone to go back to his website and revisit this all-important issue. _______________________________________ (Continued on page 69) |