|

The Stock Room page 85

|

|

(Continued from page 84) Happy 4th! _______________________________________ apppro’s take for 06/28/2008 @9:30 am EST: That sure was a week to forget! The shorts are totally in control as I predicted would happen, albeit a year too early.L The end of the quarter ‘Window-Dressing’ also made things more volatile. The ‘3 Golden Rules’ (see my 03/22 blog) must be implemented ASAP, and this is now even more critical after you should have already read the Confessions of a Short Seller from my 06/24 blog. I guess we could blame it all on oil, but as you see in this video there is no consensus on that either. Oil Fight Pay close attention to Jack Bouroudjian, the guy fighting with Rick Santelli. He’s right imo, but Santelli gives no one a chance to talk. Rick’s condescending tone also makes discussing things with him exasperating, so you just give up (besides from running out of CNBC segment time). I do take some gratification in the knowledge that I talked about this ETF oil (USO) issue a while ago. (See my 06/07 blog.) Personally, I rather listen to Sam Zell. Pay very close attention to his impression of where oil will be. He also sees a housing bottom soon. It’s just very discouraging that no one has gotten the big picture here. No it’s not oil! No it’s not subprime! No it’s not interest rates! No it’s not the week dollar, either! What it is, is a very well orchestrated gang-shorting of: 1st the monolines 2nd the commercial banks 3rd the regional banks, and now 4th the big brokerage houses As I said earlier, you keep beating people over the head, sooner or later they will break and just give up; so it is with our financial system. It’s just that only until recently has anyone, besides myself that is, realized that this Crisis of Confidence finally has taken its’ toll. Maybe now they will see this ‘Generation Me’ debacle for what it truly is. I am firmly under the belief that ALL of the above reasons would have long passed and with fewer consequences, if it had not been for those narcissistic G-Me’ers.

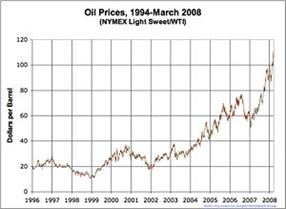

So where do we go from here? I too have given in to giving up. We can only pray and hope that Art Cashen Big Board Buzz is right. You can take some solace in the fact that the old fart usually is. _______________________________________ apppro’s take for 06/24/2008 @5:30 pm EST: How about a housing/homebuilders update. While, housing sales & prices declined again, some feel it’s not as bad as it might have been. Do I smell a bottom, or just a big pile of…..? US Home Prices Continue Record Declines in April - Real Estate * US * News * Story - CNBC.com Video - CNBC.com - Case/Shiller Report These guys sure think we’ve hit the illusive bottom. Credit Suisse starts U.S. homebuilding sector | Markets | Markets News | Reuters But for how long? That’s the real question. We’ve seen this before only to get beaten back as in May. I think we still need to let our banking system heal from all the damage done by the Generation Me’ers. Until then, there will be no joy in Mudville. _______________________________________ apppro’s take for 06/24/2008 @8:30 am EST: YOU MUST READ THIS ARTICLE! Whitman's Q2 Letter and Disclosure Requirements If those 4 reasons are true, then why the hell hasn’t the SEC done something. Reason #4 is especially deplorable. Everything that I’ve been screaming about for the last year has now come out in print. _______________________________________ apppro’s take for 06/15/2008 @8:30 am EST: Now that I reflect upon it further; Eddie Lampert may have been selling his holdings in the homebuilders over the past month, and that may have been adding to the recent slide. No way of knowing until he files. When it comes down to it, he’s been buying since the lows, while I bought in the middle ground. He may be locking in his short-term gains figuring he can buy them back later. I hate this short term thinking of sell on any gain. We have become a nation of ‘Traders’ and not ‘Investors’. Just maybe this is part of the macro problem. What ever happened to investing long term? While booking profits is never a bad thing, we must remember that the stock market is there so people can gain access to $ in order to CREATE something, so that our society can grow. Yeah sure! Just remember that you will have to pay a higher tax rate on that short-term sale – 28%ish. Now if you want to go and buy it back, you have to realistically wait until the stock goes down 15%ish to make your paying the taxes worthwhile; otherwise you’re just paying the government for the honor of pushing buttons on your computer. Oh, don’t forget to include commission fees, but those are so minor lately that it really shouldn’t have too much of bearing on 500+ share lots. _______________________________________ apppro’s take for 06/14/2008 @8:30 am EST: I was asked whether I thought the sell-off in the homebuilders was over. Why anyone would ask moi is beyond me. Go figure! Well you asked, now you have to pay the price; so read on McDuff. I use the Homebuilders’ ETF (XHB), because picking the exact homebuilder that will survive is almost impossible. With the XHB, I get a good diversity across the entire sector. Just a little over a month ago the XHB had gotten back to over $24.00 after hitting a new low of $15.22, and I thought we were on our way back up. Then – BAMMM! Back into the abyss! XHB Chart It looks like it—I—may be retesting that low. Damn! The same thing happened with the XLF. Another looser! Even the almighty Eddie Lampert of Sears & Kmart fame, can’t get it right with the homebuilders. Not that he has gotten it all that right with Sears (SHLD) & Kmart, either. He’s been buying the homebuilders up like crazy since January. Video - CNBC.com & Video - CNBC.com At least I’m in good company, not that it’s any consolation. I still won the booby prize with my holdings. As to whether it’s over, I guess if you live in Stockton, CA you wouldn’t feel that way, but I still think things might be getting better. Hey, New York City prices are still through the stratosphere. However, I am giving in to the “experts” who still seem to be saying that we’re not quite there yet. They (Who are they? It must be them.) keep saying that housing inventories are still too high and prices have not bottomed out just yet. Timing the Rise of the Phoenix I do take some solace in that April pending sales rose 6%. April pending home sales rise. Prices had to tank to get that, but the glass is half full I guess. But to me the biggest issue is the demise of the mortgage and credit markets. I’m not going to get into the tirade about short sellers destroying the CDO, bond insurers, and mortgage companies again. Suffice it to say again and for the last time, “TIRAD..TIRAD..TIRAD!!!!!!” Until the everyday person can get a mortgage without having to cut off his left testicle in order to get that mortgage, nothing good in the housing market will happen. I don’t say to give loans away, just don’t make them impossible to get, either. Has no one ever heard of a happy medium! None of this will happen however, until we get our financial system out of the toilet. It is generally assumed that the bursting of the so-called housing bubble lead to the demise of our mortgage and banking system. Conversely, it will be the financials that will lead the housing sector out of the doldrums. What we need is for the financial bashers to just put a sock in it already. I am not sure who elected these guys as the overseers of our well-being. I know that I am missing a few years from the late 1960’s, but did I miss the vote to elect these megalomaniacs as our guardians? The narcissistic behavior of the David Einhorn’s and Bill Ackman’s of the world needs to STOP. These guys really seem to have some deep-rooted, personal issues. Way too much breast-feeding I guess. The entire “Generation Me” truly needs to get a new set of priorities. Guess that’s the problem in a nutshell – hence the ‘ME’! It would appear that they learned their tactics from the CIA. Hey guys, water boarding is illegal! Beat someone over the head long enough and sooner or later they will break. Our financial institutions are no different. They are just companies which are made out of people. No matter how well intentioned they are, people/companies will screw up. If you beat them over the head over and over and over again when they do make a mistake, they too WILL BREAK! Less I digress, just let our financial system heal from all the abuse and a healthy housing market will return. Enough is Enough! Until then – squat! So, after all that do I recommend buying the housing sector/homebuilders via the XHB? Yes, if the value goes up from here—No, if the value goes down. _______________________________________ apppro’s take for 06/12/2008 @8:30 am EST: I mentioned oil only as a backdrop to the overall manipulation and deplorable greed that goes on in this market. (See RasonX’s blog below.) Oil is just another example of how we are all getting screwed over by a very small group of speculators & shorts for their own benefit. Life is more than just amassing a large fortune (bitter?). There is a greater good out there: “The good of the many outweighs the good of the few, or the one.” You make up your own mind. I have many links below that you can look thru. Just remember that there are many versions on this. There is an entire line of thought that doesn’t give the dinosaurs’ credit for oil at all, but rather that oil was created by the Earth and still is creating it. Oil formation - CreationWiki, the encyclopedia of creation science In the end it doesn’t really matter what created, or still is creating oil. The fact is that the price to get oil out of the ground is around $18.00 per barrel. Add some transportation, processing costs, & some profit and you can stretch that to $40.00. So how the hell do we get to $138.00????? Fine, double it for political and hysteria issues. Now you get $80. Even if you want to say that oil will start to run out in 2050, what the hell does that have to do with oil now! OK, add another $5 to the $80. Where is it TODAY? Oil has made a ridiculous leap in the past several years. A jump from $40 in 2004 to $140 in 2008 is not being caused by actual events. It’s all speculation & when it comes down to it – GREED! Bend over and get greased! Feel good? Oil price increases since 2003 - Wikipedia, the free encyclopedia History and Analysis -Crude Oil Prices Light Crude Oil (CL, NYMEX): Weekly Price Chart “And that’s all I’ve got to say on that.” _______________________________________ RasonX’s take for 06/12/2008 @6:30 am EST: Oil prices maybe in the very short term propped up by "speculators" but you could say that about any stock Apple for example. Buyers of the stock speculate that in the future everyone will buy an iPhone. Those "speculators" are probably right. Likewise speculators are buying oil because everyone will buy oil, and more of it. There are two main reasons for this, supply and demand. The demand side: The US uses 5% of the Worlds Oil. Yet consumes 25% of the worlds oil. If everyone in the world used as much oil as Americans do we would need 20 PLANET EARTHS TO SUPPLY THE WORLD WITH OIL!!!!. I don't think ANWAR has 20 Earths worth of oil (sorry about that, that really applies to the supply side of the equation.) The supply side: In 1950 geologist M. King Hubbert predicted that in the 1970's America's would never produce more than the year before and then produce less and less every year there after (think of a bell curve or google Hubert's Peak). Hubert was laughed at yet proven right 20 years later, LOOK IT UP. The same has been predicted for the world's oil supply. Between 2005-2012 the world's oil production will peak and fall every year after. THIS WHILE DEMAND IS GROWING AT ITS FASTEST RATE BECAUSE OF INDIA AND CHINA. Yes there are speculators in the oil market. BUT THEY ARE MAKING THE CORRECT SPECULATION. 1 year from now I will speculate that oil will be over $200 per barrel. But its not really speculation its like speculating that winter will be colder than summer. DUH! _______________________________________ apppro’s take for 06/11/2008 @6:30 pm EST: Someone (actually 2 people) questioned me on the price of oil and my view that its’ way overvalued. You may want to check out the following link that 1 person sent me: The Oil Drum. OK, I could be wrong, but I don’t think so. Only time will bare out who is right. Boy do I hope & pray it’s me! Even the almighty Boone Pickens got it wrong just this past January – he went short. OK, now he changed his mind and went long, but that’s only because he’s wants to drive up the price so his 'alternative energy' investments will make sense. The price of oil will break only when it suits the speculators’ pocket book, and not until then. _______________________________________ apppro’s take for 06/07/2008 @11:30 am EST: Yesterday was the 64th anniversary of D-Day. On that historic day, the Beaches of Normandy were invaded by tens of thousands of American heroes with the ultimate goal of freeing all of Europe from tyranny and depression. Well, unlike that glorious day, yesterday Wall St. & our financial markets were invaded by a very small group of short sellers, hedge funds, speculators, and other entities with the goal of their own personal gain with little or no regard to society as a whole. Just a disgrace! I also really don’t want to hear the garbage again that it’s not the shorts or speculators. After the past 2 days that can no longer be claimed. Oil is not worth $135/barrel on Monday (not that, that price is right), and then is worth $122/barrel on Wednesday, and then $138/barrel on Friday. Insanity! There are some that called what happened on Friday the ‘perfect storm’ :

Firstly we got a moronic call for an attack on Iran out of a minor Israeli official. CNBC.com <<Further support came from remarks by Israel's transport minister that an attack on Iran's nuclear sites looked "unavoidable." It was the most explicit threat yet against Tehran from Prime Minister Ehud Olmert's government. >> Moronic! Israel knows that an attack of that magnitude is not in their best interest. Iran is not Iraq and sending a few fighter jets other there to destroy a nuclear facility would generate a very large and devastating reaction. Not good for anyone! All this did was to throw panic into the oil markets and send oil futures off to the races, and I don’t mean the Belmont Stakes. Secondly, we had an employment report, or better called a lack of employment report, that called for a 5.5% unemployment rate in May, largest in over 3 years. Video - CNBC.com But they really didn’t give enough coverage and credence to the fact that a large and unexpected surge in college/school students entry into the market caused it. Usually it’s applied in June, but the government screwed up the numbers this year and put them into May. Our government screwed up the numbers – go figure. Thirdly, we had some hawkish comments made by France’s European Central Bank President Jean-Claude Trichet’s about raising Europe’s interest rates, something no one wants or needs. This caused the dollar to collapse, which caused oil to spike further, and the market to tank on US inflation fears. Lastly, and the final fly in the ointment, was the unprecedented gall of a Morgan Stanley analyst that called for oil @ $150 by July 4th. Talk about irresponsibility! It’s bad enough when we have an oil expert like Boone Pickens predicting this kind of bs for his own personal gains, yet alone some wannabe from Morgan doing the same thing. A self-fulfilling prophecy does exist you know. Where is our SEC regulating this kind of nonsense!

All in all, this confluence of events allowed the ‘bears’ out in force and took everything down. Little was spared; even my sphincter muscle took it hard. Just deplorable! I’m also now seeing a very large issue with my beloved ETF’s. What I thought were fabulous trading tools are now causing a lot of these price spikes, and for all the wrong reasons. Let’s take the USO for example. U.S. Oil Fund (USO) This ETF follows the price of U.S. crude. What seems to be happening is that large Union & State 401K funds are buying these ETF’s in large quantities in order to protect their member funds as a hedge against inflation. These buys were not happening just a year or so ago. To buy oil, you had to go to the NYMEX and buy it. Now anyone can buy as much of it as they wish. All these fund managers need to do is log on to their trading web site and plop down their $ into the USO. As these funds buy it up, the ETF’s actually have to go and buy oil futures. This causes the price of oil to go up further, even though no one is REALLY buying the oil. The more these funds buy the USO, the higher the price of oil goes. There is no real supply/demand ratio going on here, just 401K funds buying oil futures. Get it? You better, because you’re getting it up your you know what whether you invest in this market or not! _______________________________________ apppro’s take for 05/19/2008 @8:30 am EST: Normally I wouldn’t post at this time or things like this, but in response to some of the naysayers all I have to say is: HA! Mon 8:00am PAY OSI Selects VeriFone's Secure ON THE SPOT Vx 670 Payment System for Carrabba's Italian GrillBusiness Wire Mon 8:00am PAY VeriFone Provides Tim Hortons with Payment SystemsBusiness Wire _______________________________________ apppro’s take for 05/17/2008 @9:00 am EST: That was a good week, only because we didn’t get a lot of stupid, bad news. Actually, new weekly unemployment claims didn’t go up that much and housing starts went up nicely for April. All in all, not too bad – that is unless you need to eat, drive, or pay for rent! I sound like the Brady Bunch: Inflation..inflation..inflation! Sucks big time and at its base is oil. I’m not getting into the 6 degrees of separation theory for why oil is the route cause; just think of transportation and manufacturing. You can also add in ethanol.Alert: Plus water! NYC just added 14% to your water bill. Talk about flushing away money! Where did I put those water stock links?Now that you’ve heard the mainline theory, you can forgetaboutit! It all comes down to ‘speculators’ betting heavily on oil going in either direction. Actually, these guys don’t give a hoot which way it goes, just as long as it goes somewhere quickly and(Continued on page 86) |