|

The Stock Room page 46 |

|

(Continued from page 45) manageable.” Again we have the right analysis! What we had were financial instruments that were NOT failing, but rather because of M2M (mark-to-market) they were being valued as failed. What we had were a small group of individuals who wanted these to appear to fail for either of 2 reasons. 1. That they had made substantial SHORT bets on the holding company, and needed these financial instruments to become worthless in order to profit from their gambling bets. Or 2. A group of speculators that wanted to buy up all these supposedly worthless mortgages, because actually they knew that they were just worth_less. We all have seemed to have forgotten about all the buying up of these so-called toxic assets! What short memory we truly have!

So what we have now are the very same financial institutions that helped us get through this crisis, finally being extorted into paying off the very same muni bond insurers that were forced into oblivion by the very same short sellers who started this mess in October 2007. We now blame it on ‘robo-schmobo’, but don’t get it wrong: This was the end result of shorts’ actions that stemmed from M2M and the blatant rumorboarding that emanated from the elimination of the uptick rule. FULL CIRCLE! So what have we learned? SQUAT!

_______________________________________

apppro’s take for 04/14/2011 @ 06:00 pm EST:

“Counterfeiting Stock”

narrator sent these ABSOULTELY FABULOUS links on naked shorting. MUST MUST READS!!!!!!!!! Citizens for Securities Reform Counterfeiting Stock - The SEC Shelters the Securities Industry Counterfeiting Stock - Explaining illegal naked shorting and stock manipulation For the 1st time I finally read where someone almost gets the entire crisis and even where is all started – almost! “The subprime mortgage crisis that boiled over in the spring and summer of 2008, witnessed actions by the industry and the SEC that illustrate how the prime brokers victimize companies with naked shorting, but when the game is turned on them, they run to the SEC for protection and get it. The subprime crisis did not start as a result of wholesale defaults at the home owner level. While defaults were up somewhat from the prior year in absolute terms, they were not that bad. In addition, absent fraudulent underwriting, the recovery on a foreclosure historically has been a very high percentage of the loan amount. In most markets, the real losses were manageable. Mortgages are pooled by Wall Street and those pools are rated by the credit rating agencies, usually as AAA, which means they are supposedly risk free. These pools usually borrow money that is secured by the mortgages in order to leverage up the return. Typically the assets are long term and the borrowings are short term. The shorts started attacking the investment bankers with the large subprime pools, including Bear Stearns, Merrill and Lehman. The attackers were a consortium of large hedge funds and other investment banks, notably Goldman. It has been alleged that the shorts started spreading falsehoods that were picked up by the short media. Suddenly short term credit was denied to the target investment houses because of the perception that there were credit problems. The lack of available liquidity put them in dire straits. As a result, Bear was forced to the brink of bankruptcy.” As I’ve been screaming now for 4 years, the above missed the main point in 2007 by a year. The crisis started in July 2007 when the SEC got rid of the uptick rule, but really got its footing when shorts convinced FASB to apply ‘MARK-TO-MARKET’ (M2M) to the financial world in October 2007. In brief, M2M allowed shorts to value 30-year mortgages on 30-minute scenarios. Through massive rumorboarding, in late 2007 shorts used M2M to bring down MBIA & Ambac, and this served as the blueprint to bring down Bear Stearns… then WAMU… and so on, culminating with Lehman’s! GREAT FIND NARRATOR! _______________________________________

apppro’s take for 04/14/2011 @ 08:00 am EST:

“Another Commission President”

Don’t get me wrong, I think the Republican Plan is just as bad, if NOT worse. Obama’s deficit-cut plan at loggerheads with Paul Ryan’s GOP Plan | Industry Leaders Magazine A Glimpse Into The Land Of Paul Ryan's Austeria I really don’t think a total and complete overhaul of our current social system – Ryan’s plan is really a total dismantling – is best for this Country, either. I am also not convinced that with appropriate adjustments and TRUE cost controls, that Medicare and then Social Security cannot be fixed left much intact! Neither plan addresses S.S. at all, and both plans address Medicare in a purely bipartisan way – all or nothing approach – my way or the highway attitude. Instead of just establishing another stupid commission, Mr. Prez why don’t you put Mistress Elizabeth Warren in charge? If she puts half the effort she has into further destroying the rest of our banking system into figuring out Medicare… well, we’ll have a plan in 2 weeks. And as far as the Prez’s raising taxes on the rich proposal – GO BABY! I’ve had enough of ‘Trickle Down Economics’ that I really see as ‘Piss All Over Everyone Else Economics’! Personally, if we just go after the roots of our mess, we just might find enough tax revenue anyway! STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years* - 5% tax on capital gains 2. Capital gains 2 > 5 years* - 15% tax on capital gain 3. Capital gains 1 > 2 years* - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund. *Anyone whose main source of ‘income’ (retired persons excluded) that comes directly from capital gains, should be taxed at never less than the 1>2 year 35% rate—no matter what the cg term length. The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________

apppro’s take for 04/12/2011 @ 06:00 pm EST:

“Bubble… Bubble… Toil and Then More Bubbles!” Part Deux In the meantime, the rest of us just get screwed over again, especially at the pump, all the while our financial markets have violent swings. THIS IS NOT GOOD FOR ANY OF US! Follow the money and you’ll be lead right back to a naïve and ratings hungry media who enable the traders/traitors that have speculated and shorted our system again almost to the brink! And people, this is just not oil, but gold and silver and even the corn and wheat that we have to eat! Face it, the mere existence of the VIX (measurement of financial insanity) and its accompanying ETF’s, is proof enough! Just like Al Qaeda, these short-term traders/traitors need angst, uncertainty, turmoil, & volatility in order to gain a foothold and to exploit the masses! These option traders/traitors are just bookies for gambling addicts… that’s the fact Jack! And BTW, WHERE THE HELL IS OUR PRESIDENT DURING ALL OF THIS? I thought Bush was bad, so bad that on 03/15/2008 @9:00 am EST I labeled him a Nero – fiddled as Rome burned; but Obama has been silently worse! See, I’m an equal opportunity president basher! _______________________________________ apppro’s take for 04/11/2011 @ 08:00 am EST:

“Now It’s OUR Turn!”

I told you last year around Thanksgiving that after this evil-doer destroyed most of the European Continent, he would reverse march and come after us. I quote:

PIMCO Officially Goes SHORT The US Treasury Market Yes people, we all need to get our national debt under control, BUT we do NOT have to do this over a couple of weekends like we did to Lehman's. We all know how that turned out! _______________________________________

apppro’s take for 04/08/2011 @ 08:00 am EST:

“Total Insanity – Oil @$110.00!” Now I really have heard or in this case, seen everything! This oil trader appeared on that horrid CNBS show Fast Money. Yeah, I know – why do I even watch! This experienced oil trader told EVERYONE POINT BLANK that oil was being speculated to death and that oil should be no higher than $80.00 at this point in time. He went on to complain about the traders/traitors and SkyNet that have taken over the commodity exchanges, and begged for someone to stop it! Sound familiar? But what really got to me, was how those jerks on the show just sat there with their mouths wide open as if this came as a total and utter surprise. Surprise… surprise… surprise... these are the very guys causing the mess by hyping oil and buying the ETF’s like crazy! They are the enablers! They all then ask, “But what can WE do?” No answers from some of the very people who are contributing to this mess! Well, you know what will stop it! What is wrong with the rest of us? Are we all that stupid or oblivious? Please everyone, scream or call or tweet or whatever you do to force our so-called leaders to see what is going on and to: STOP THE INSANITY NOW! Oh, when you finish vomiting over this, please listen to this short-seller moron and how we all need to just buy ‘useless gold’ and basically just wait for the nukes to arrive! What an idiot!

_______________________________________

narrator’s take for 04/07/2011 @ 03:00 pm EST: narrator’s website: SiriusNews.com

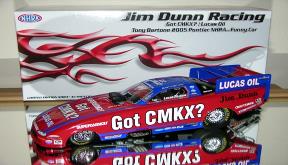

THE CMKX STORY

_______________________________________

apppro’s take for 04/07/2011 @ 09:00 am EST:

Congratulations?

YEAH! We have now gotten up to speed Al Qaeda’s ability to export oil to China so that they can fund their ultimate overthrow of US! And how the heck did China, who didn’t want to allow anyone to get involved, get the 1st shipment from those rebels? Tweet that! (Continued on page 47) |