|

The Stock Room page 56

|

|

(Continued from page 55)

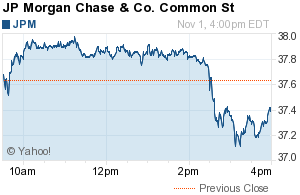

All this did was to create a great deal of anxiety, and tanked JPM and the entire markets along with it. Come on people, most of us wouldn’t have even bought a used car from this slob, but his need for his “15-minutes” created so much angst, that even one of those moron traders/traitors from FastJerks admitted he sold his new JPM position because of the ‘sell 1st ask questions later’ syndrome! When are we all going to wise to and DEMAND more out of our media? When? This insane market must stop. When a professional like John Bogal makes a comment like, “This is the most speculative market ever!”, I think we need to stop and listen. Until we stop this craziness, nothing will get better, and that moronic ‘New Normal’ will surely become the new normal. We must stop this negativity and angst so that people will want to invest… which will help create jobs… which will increase prosperity… which will lead to happiness, security, and a general well-being! _______________________________________ apppro’s take for 10/30/2010 @ 09:00 am EST: Be Afraid! Be Very Afraid!

And on Halloween you think this is scary?

We are now opening the proverbial “Can of Worms”, but this time we will have no way of putting them back in. Vultures seeking to recoup whatever they can from whomever they can are coming out of the woodwork in droves. Day after day we get another group trying to sue someone for something that happened years ago, ALL because now they think they can get lawyers to extort money’s out of companies for SOP’s that just yesterday no one even considered to be an issue. Let’s not get into every one of these examples, but the underlying theme of letting lawyers loose upon us all – well that should scare the hell out of you, as it does me! Tribune Lenders Sue JPMorgan Claiming Buyout Was Fraud - Bloomberg SEC Urges Banks to Disclose Potential Losses From Flawed Home Foreclosures - Bloomberg The Next Mortgage ModificationsWells Fargo Emerges as Target, Role Model in Foreclosure Probe - Bloomberg Do any of these cases have some real merit? Maybe so, but we cannot allow this inane, no insane desire to have lawyers dig into every legal process of the past 200 years to actually occur. To give lawyers free reign over our entire system, as we have the ratings hungry media promote the insanity, well that will be the real travesty of justice. We are tearing the very fabric of our economy and society apart, and for what long-term good? The media is having a field day with this, and this Nation cannot afford to spend the next decade ripping apart every process that the media has now deemed as ‘fraud’, only so that a few bond holders (Pimco) via their lawyer army, can try to recoup some more money from loses that was their responsibility to conduct due diligence on in the 1st place. The only people that will come out of this on top are the lawyers. Does none of this remind you of the period of 1999 thru 2001 during the collapse of the infamous ‘tech bubble’? Do none of you remember how law firm after law firm would issue press release after press release about a class action lawsuit after class action lawsuit about one tech company after another tech company that had gone belly up, all because everyone had started to doubt their metrics? The only thing that EVER came out of any of that, was a whole **itloads of lawyers’ fees and very LITTLE of actual investor reimbursement, if any at all! I personally am still getting papers over Purchase Pro! LOL! Everything always flows down from the top! I’m sure you’ve all heard about “Trickle Down Economics”, well in this case what we have is “Trickle down Negativity”! Only in this case it’s been a flood and not just a trickle! The ’Obama and I didn’t cause the Situation’ has used his office to bash our system to such an extent that little can recover. Actually, if I am not mistaken, the entire White House has been taken over by lawyers… and if that doesn’t say it all, then I have no idea what will! _______________________________________ apppro’s take for 10/26/2010 @ 07:00 pm EST: Judicial and Moral Hypocrisy Now I’ve seen, or in this case read everything! For weeks now many have been calling for the banks to stop all the foreclosures. Judges and lawyers and politicians and anal_ysts have been calling for this stoppage because of minor errors that may have occurred due to the ‘robo-schmobo’ silliness. Whatever! Now a Florida Judge has admonished the banks for doing just that! “It’s very frustrating to have put in this effort to design, plan and implement this system and when we finally get some forward momentum, we start slowing down again because of the banks.” Florida Foreclosure Auction Cancellations Frustrate Miami Judge - Bloomberg Wait a minute here! Didn’t these same judges say to stop the foreclosures due to roboing? Am I missing something here? The real joke of it is, is that the stupid media didn't even seem to think to mention the idiocy of the fact that these judges are blaming the banks for what other judges and State Attorney Generals have been screaming for them to do – to stop the foreclosures. Yeah the Judge here was right, BUT FOR ALL THE WRONG REASONS! However, the hysteria promoting media didn't think to even acknowledge that! The banks are 'damned if they do and damned if they do', but no one, especially the media seems to want to take that in to account. In the meanwhile shorts are destroying our banking system – AGAIN! Deplorable! Just deplorable! _______________________________________ apppro’s take for 10/26/2010 @ 08:00 am EST: Does no one else see the similarity of these two? Both for their own greed sucked/are sucking the life out of the rest of us! _______________________________________ apppro’s take for 10/24/2010 @ 06:00 pm EST:

Proof That America Still Hates Wall Street - Deal Journal - WSJ

I really can’t disagree. Hey, I hate them too; but my hatred is directed at the ones that put us here and not just the easy political targets. Many of you may have seen the newest ‘Wall Street’ movie. This is not another review; I already gave you my opinion… just so so! What I want you to think is: Of the 2 men pictured below, did you walk out of the theater hating both? Jacob Moore (Shia LaBeouf) or Gordon Gekko (Michael Douglas) I’m sure most are going to say that they liked Shia and hated Michael – which I guess was the objective. So, if these were the guys on the real Wall St.; would you say you hated everyone on Wall St or just a specific set of villains? This is my point! America, as the above article portrays, should direct their hate at the real villains of our collective misery.

Instead of directing your hate at the banks, direct it at the ones that almost destroyed the very banks you hate so much. And I hate to tell you, these guys are still at it and the banks may come tumbling down anyway leading to a crisis that will make 2009 look like child’s play! Hey you ‘middle-class’ out there, whoever you maybe, we ALL need a mind reset which takes us out of the ‘Trader/Traitor Decade’ and promotes the rebirth of investing and growth! One thing is for sure, we can’t regulate our way out of this—more rules will not change bad behavior—taxing it will! STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years - 5% tax on capital gains 2. Capital gains 2 > 5 years - 15% tax on capital gain 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund.

The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________ apppro’s take for 10/22/2010 @ 07:00 am EST:

Juan Williams at odds with NPR over dismissal

“When an analyst states personal opinions on an issue, our feeling is they have undermined their credibility as an analyst."

If we use this as even a loose standard for what reporters should or should not say, then:

EVERY ONE OF THOSE BOBBLE-HEAD, NARCISSISTIC, SO-CALLED REPORTERS ON CNBS & FoxBS SHOULD HAVE BEEN FIRED YEARS AGO! (Note: Fox is not as bad; but no one trades on their every word, so who cares!)

And that’s just my opinion! _______________________________________ apppro’s take for 10/20/2010 @ 06:00 pm EST: And still even after everyone - and now the White House too - keep saying that there is no systemic issues, especially fraud, even now the insanity over ‘robo-schmobo’ doesn't end. What about this group of 3 that are trying to recoup losses. Besides from the obvious TFB, everyone really should be asking, “Where was their due diligence??” What about their ‘personal responsibility’? These mortgages weren't sold to them directly from Bank of America or even Country Wide at the onset. These guys bought these on the cheap or were given them for free after the collapse occurred. Hey, who asked them to buy them or even to get involved? Where is their responsibility to know what they are buying? They were trying to get a bargain, well sometimes you get a dog, but that’s not BoA’s fault!!!!!! Take your loses like a man/woman/whatever! Move on! _ _ _ _ _ _ _ _ I promised narrator that I would link his latest video on the SEC/Diamond scandal, but I sure wish he would spend his time fighting the above insanity instead. _______________________________________ (Continued on page 57) |