|

The Stock Room page 80

|

|

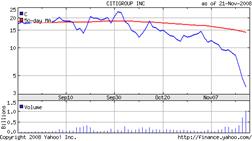

(Continued from page 79) The founding fathers of America, built up ideas and blueprints to make it the greatest country in the world. In the past few years, sharp-witted, educated wizards have devised schemes that first of all over-leveraged complicated financial instruments. This in turn has fed the short selling vultures to sell America short and to hell with all who stand in their way. The greedy few get richer in money but poorer in spirit, while everyone else just becomes impoverish. _______________________________________ apppro’s take for 11/24/2008 @ 7:00 am EST: Well, we all now own more of Citibank! I’m so happy that everyone is so content on just sitting back and allowing the greatest transfer of wealth to continue to happen. From almost everyone else to a few Me’er shorts! Deplorable! Just deplorable! Until the root cause is addressed, all that will happen is that the locust shorts will move on to the next victim. The 4 Golden Rules 1. Reinstate the Up-tick rule 2. Crack down on naked shorting 3. Institute some rules on what should be said on National TV to prevent rumor-mongering 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. BUILD.. BUILD.. BUILD. JOBS.. JOBS.. JOBS. DRILL.. DRILL.. DRILL. _______________________________________ apppro’s take for 11/23/2008 @10:00 am EST: It appears that Bush has thrown in the towel and said to hell with all you ingrates. Fine, to hell with him! Meanwhile, Obama is so busy trying to be politically correct (in the true sense) and while announcing team members has declared that there is “Only one President at a time!”, so he’s not getting involved. Roosevelt did the same thing to Hoover and we all know what happened then. Fine, to hell with Obama, too! This is NOT a political blog, and I refuse to get any further into either of those men’s deficiencies. Leave it to be said that unless they address the TRUE cause of all this mess, then I guess they’re saying, “To hell with us!” All we need to do is look at what has happened to Citibank these past several weeks.

After a brief respite in the high teens after TARP funding, we allowed the shorts to just utterly destroy the stock and bring them to their knees. I would like anyone to give me 1 reason why Citi should have suffered so much in just 1 week. I would like anyone to give me any example of what if SO different in their financial state in that same period to warrant that sell-off. No matter what you want to say: Deal Journal - WSJ.com : Citigroup: If You Can't Save the Stock, Blame the Shorts shorts have caused this mess and after 1½ years of giving you proof, well I’ve said enough on the subject. I just pray that our Government sees it before they use the solution to the last great depression >> World War II. I know, all I am going to get is a replay of the shorts theme song: “No.. no.. no it ain’t me babe! It ain’t me that you’re looking for.. babe!”

#4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. So we can: BUILD.. BUILD.. BUILD. JOBS.. JOBS.. JOBS. DRILL.. DRILL.. DRILL. _______________________________________ apppro’s take for 11/20/2008 @8:30 pm EST: Deplorable! Just deplorable! All you need to do is listen to these 2 clips, then we close our borders and put an “Out of Business” sign up. Just unreasonably depressing and a true self-fulfilling prophecy alert. The 4 Golden Rules 1. Reinstate the Up-tick rule 2. Crack down on naked shorting 3. Institute some rules on what should be said on National TV to prevent rumor-mongering 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. _______________________________________ seeker’s take for 11/20/2008 @7:00 pm EST: seeker’s website: PointofLife.com

How to Stop The Short Sellers by Michael Levy

We all know naked short selling is illegal so anyone who does that will go to jail. So how do we stop the other short sellers from taking down the stock market. Well, as with most things in life, the answer is easy once we know how the system works. Most investors do not realize that their stocks can be lent out to short sellers if it is a margin (type two) account. A cash (type one) account cannot be lent out. There are two types of trading accounts...Type one account cannot be used by short sellers to borrow against to short stocks as none of the stocks in that account are on margin. Type two trading accounts are margin accounts and even though the stocks are not margined they can be loaned out by brokerage houses to short sellers. Therefore, I am calling on all stock traders who do not want their stocks to be used by brokerage houses to loan to short sellers to transfer their accounts over to none margin accounts. This way short sellers will have to cover their positions as they will not be able to borrow any stocks to short, as most margin accounts will be closed. It seems the government will not help the people, so the people need to help themselves. The small investor may only be one small drop in a large ocean, however, when they all act together they can make a difference in the ebb and flow of how stocks are traded. _______________________________________ apppro’s take for 11/19/2008 @7:30 pm EST: Deplorable! Just deplorable! Another several billion dollars worth of our society’s value loped off. I guess those shorties I blogged about on the 15th came back from Washington, DC and said to themselves, “WOW! Hey, we got away with everything!! OK boys, let’s short the living daylights out of the entire market since they all think we’re gods anyway and no one seems to care what the frig we do!” Under the realm of ‘too little too late’, Maria Bartiromo of CNBC was willing to interview someone on the ‘Shorting of America’, to paraphrase seeker. But honestly, her tone was more of reluctance then true appreciation and understanding. Short-Selling Debate Continues What really got to me though, was another segment (towards the end) in which Maria pleads, "Where's the CEO's?" What hypocrisy! For almost a year now, she and almost all of the CNBC reporters have been bashing our CEO’s, and saying they all should be fired and even belonged in jail. Now that we have driven them ‘off the wall’ (see my blog of 10/11/08) and into hiding, she has the nerve to ask why the hell are they not speaking out? Well Maria, they’re not talking, because every time they do someone calls them a liar and thief (hint.. hint); then shorts come back in to further drive the stock into the ground. Can you blame them for avoiding more unwarranted torture! Just as a side note, I would love everyone to look at this picture of a major retailer I took today at 3:45pm. From 8:00am these lines were like this all day and at every register. The consumer does not really want to be declared dead, so STOP IT! But everyday we allow shorts to further destroy our markets and our confidence, we get further and further away from the point of no return. _______________________________________ apppro’s take for 11/18/2008 @6:30 pm EST: I really don’t want to steal away from seeker’s blog below. He asks an excellent question, but unfortunately his wish list is imo very unrealistic. I also, can’t agree with the part of his question that basically asks, “Why is this night different from all other nights?” Well, it’s not, and rules should be consistent no matter what the current conditions. This has been one of my bet peeves for a long time, and I can’t endorse using the ‘Why not change it now?’ argument at my own convenience. Changing some long-standing rules in the middle of the game is a main reason how we got into this mess in the 1st place. You know I have been screaming about some of his requests for some time now and proposed several solutions; all you need to do is look at my 11/15 blog from 3 days ago. We also must contend with certain anal_ysts who carry far too much credibility and whose comments really don’t address the real issues, either. Video - CNBC.com With that said, I will step back and let you all enjoy seeker’s blog, as it is very good. _______________________________________ seeker’s take for 11/18/2008 @2:30 pm EST: seeker’s website: PointofLife.com

The Insanity of Allowing Short Selling in a Recession by Michael Levy

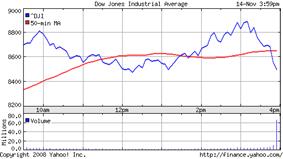

Let's start by asking a few questions... Would you send your children to a nursery that was run by cannibals? Then why allow short sellers to crucify stock prices when they are at their weakest? Why does the SEC allow billionaire short selling Hedge Funds to control the destiny of troubled companies that sends them into bankruptcy when they may otherwise be saved given time to reorganize? Why does CNBC TV and other media outlets give massive time coverage, in most of their daytime segments, to short selling billionaires, who explain their propaganda, so that other speculators can follow their parasitical method of breaking company stock prices systematically down to devalued levels and many times bankruptcy? In the same manner as speculative propaganda drove up the price of oil to an unrealistic price of $147.00 a barrel, so called expert intellectualized propaganda is driving down stock prices to lower than the book value of many companies assets. This in turn causes massive layoffs in jobs. We all know jobs are lost in a recession; however, short selling is making it far worse. With leveraged ultra short index fund EFT's stock prices can be traded down in double quick time which adds oil to the fire of discontent. Therefore, it is preposterous to allow short sellers free reign when the USA is in recession. Surly, it is in most people’s interest to keep companies in business and employment at the highest level possible so that the recession can pass by quicker. The remedy is for the government to immediately step in and demand the SEC halts ALL short sellers until the recession passes. Also all short positions should be covered within one week. This will send stocks up 2000 points and put a bottom under the markets. It will also save the jobs and companies that are now struggling to survive. I recently enjoyed a French movie titled Avenue Montaigne that had some profound messages. In one scene an actress explained to a young woman that just before the lights go down she often observes people scrabbling for an empty seat that is closer to the stage. In their frenzy to get closer, they do not understand that if they get too close they will see less. In the same way the short sellers need to realize the more money they are making by shorting stocks, the more pain they are inflicting on the whole of the world financial markets that follow the USA's lead. Enough is enough and the government senators need to stand up for the peoples financial assets, moral values and be counted upon to do the correct course of action to stop short sellers in their vulture like tracks. _______________________________________ apppro’s take for 11/15/2008 @9:30 am EST: I really don’t understand what we are trying to accomplish here? We allowed a very small group of individuals to destroy our confidence in the muni bond system, then we allowed them to destroy our confidence in the mortgage system, then we allowed them to destroy our confidence in the investment banking system, then we allowed them to destroy our confidence in the commercial banking system, then we allowed them to destroy our confidence in the insurance system, then we allowed them to destroy our confidence in our financial markets, and now we’re allowing them to destroy what little confidence we have left in OURSELVES! Yeah, we all stopped spending in October, what do you expect when all the pundits, media, and so-called financial experts keep telling us a depression is coming. Well, be very careful what you wish for! I said well over a year ago that all the negativity back then would make things end very badly – well we’re there. Oh yeah it can get a lot worse, but what’s the point. IT DOESN’T HAVE TO BE THIS WAY!!!!!!!!!!!! “The future has not been written. There is no fate but what we make for ourselves.” BUILD.. BUILD.. BUILD. DRILL.. DRILL.. DRILL. But what really makes me puke is what happened yesterday in Washington concerning the Congressional Hearings of ‘hedge funds’. Let me be clear, I have no issue with the traditional hedge fund. Traditional hedge funds basically just use a way of trading that straddles a stock price on both the up and down side. Nothing wrong with that, but those are not the funds I’m bitching about. Even the great George Soros, the king of hedge funds can’t get it right all the time. It’s the few shorts that disguised themselves as hedge funds that caused all this misery. These guys had no intention of using any strategy except the one that destroys. Fine, we let them do it, but when Congress had the chance to grill these guys and finally place some blame and eek out some retribution, all they did was to kiss their asses and drool with envy. The News agencies even seemed a little stunned. Hedge Funds get hugged on Capital Hill But this comment by the reporter really sums up my outrage: “...what everyone else missed!” Missed what! There really wasn’t anything that wrong with all those mortgages until these shorts sellers convinced us all that they were ALL no good. Sure, many subprime loans should have never happened, and many should and will go into default; however, we all must remember that the vast majority of these mortgages had NOT gone bad. They may now go into default because of all the bull!%?! going on, but when those short sellers were making billions from shorting them, they had not gone bad. Yeah we missed it, because it never really was there in the 1st place, that is until the shorts needed it to be. Besides, who asked these guys to be our guardian angels and bring all of this to light, so to speak. I certainly didn’t elect them to the position! Did you? I refer back to my: #4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. Now on to the stock market for Friday the 14th. Deplorable! Just deplorable! After fighting it’s way back from a negative –350 to a positive +65 at 3:40pm, the Dow in 20 minutes tanked right back to close at –333. Why? Why not I guess.

Assholes every one of them! It’s this kind of crappola that will kill what few investors that are left. I hearken back to my tax discussion in ‘The Fix’ on 3/22 on taxing these narrow viewed, short-term ‘traders’ to the hilt in order to stop all this volatility. Want to fix bad behaviors, then make those behaviors onerous and they will stop. _______________________________________ apppro’s take for 11/11/2008 @7:30 pm EST: This market has decided that traders and shorts are more important then our society & economy as a whole. The good of the many does not mean squat yet alone outweigh the greed and ego of a very select few. Deplorable! Just deplorable! What this market now needs is a: (Continued on page 81) |