|

The Stock Room page 82

|

|

(Continued from page 81) _______________________________________ seeker’s take for 10/14/2008 @8:30 pm EST: seeker’s website: PointofLife.com

Self-Fulfilling Prophecies of Greed, Fear and Doom by Michael Levy

In the beginning, the money orientated greed god said; let there be greed and yay, it was good. Well, maybe not good, but it sure felt good to the housing cartel of owners and estate agents who were feasting on an upward spiraling market. It also felt super good to the investment banks that were hatching out leveraged collateralized notes on falsely valued homes with little or no down payments and low interest payments for a few years. House prices doubled and tripled. Trophy homes sprung up on the mountaintops and the hallelujah avaricious chorus of high-pitched prices echoed in the valleys below. All too soon the gilt began to fade on the exterior rhetoric of the experts who inaccurately stated... it will be different this time. As prices began to tumble experts began to realize they had been duped by their own cleverness and intellectual education that never taught the meaning of wisdom. Still, they stated all will be well and prices will recover soon, while keeping their fingers and toes crossed. Then the greed god directed his flock into the hell pits of the commodity markets. The self-acclaimed experts once again sang the praises of greed god's doctrines as oil prices accelerated to $147:00 a barrel. The fact that there was never a shortage was ignored. And yay, again it was good for the greedy few who knew how to use lies and propaganda as true facts. Many other essential commodities played follow the leader and as the greed grew, people in poor counties began to fight for a bowl or rice. Still, the stock markets were still doing ok. The USA consumer began to feel the effects of insane gas prices as it moved from $1:00 a gallon, huddling to $4:00 a gallon, in a couple of years. The USA economy slipped into a mild recession without anyone noticing. As the USA economy slowed, the expert choirs began to sing the praises of the economies of China and India, chanting the world economies will do dandy without the USA. They vocalized companies will still earn big profits from outside the USA as the rest of the world is booming. Yet again, the intellect experts articulated ... it is different this time. All too soon, the greed god took off his crown n robes dripping in diamond and pearls... Quietly, he snuck back to his hovel, where he eternally lives in his true garb of rags and tatters. On his way home, the fear god, who was racing to earth to inflict his erroneous powers on the gullible and susceptible educated experts, crossed his path. Once he sat on his thorny throne, the fear god employed every educated trick in his book to teach the intellectual experts how to contaminate the public with fear-laden reflections. In droves, the fear mongers began to pollute the TV and newspaper audience with their inept expert advice and unsound opinions. Many of them were the same experts who once sang the greed god's praises and now growl the fear god's doctrines in dulcet tones. News began to break that investment banks had been hoodwinked by the greed god, who was nowhere to be seen now. The banks began to falter and drop like ten pins in a bowling ally. Where once, greed reigned supreme, fear now was at the helm. People realized not all was good it was bad. In fact, it was rotten to the intellectual core and was never a good education. Governments around the world met and stated they will all work together for the betterment of all. Well, my dear reader, this is the story so far, in a nutshell. The god of doom is getting his horses out the stable and hitching them on to his chariot of condemnation. If you buy into the misrepresentation of the mythical gods of greed, fear and doom, that feed expert opinion, you may be in for a burdensome few years ahead. The media experts, producers and anchors can and do manipulate the minds of naive people who view or listen to their programs. This is because media experts, producers and anchors believe in their own educated cleverness, which exists outside the realms of their instinctive and intuitive intelligence. They really believe what they express is sound until it is proven unsound.... They will then declare the opposite of what they first expressed in the past, as if they never uttered it. Confusing ain’t it? It is no wonder people are confused and do not know how to protect their hard earned savings. If you follow the herd of misguided experts, then for sure the doom god will soon be knocking on the door of your conscious mind, requesting permission to infect your mind. Fortunately, there are a few high-ways of authentic information that can protect your sanity and keep the door to doom closed. • Panic buying or selling always leads to large losses. • Decisions made by greed and fear will lead to doom laden anxiety. • If you are still following the advice of the experts who got you into the confused mess, the doom god may take you to an early grave in double quick time. • There is a switch on the radio or TV that turns it off, discover the benefits how it works. • Get out of the habit of listening to the fear mongers. • Everything good, bad or indifferent passes with time and this too will pass. • In every human being, there is a spirit of love & joy that can weather any storm in harmonious tranquility and peaceful grace. That is the only true channel of authenticity to be aware and tuned into. A simple person understands when enough is enough and never goes hungry for authentic counseling by a higher power; whoever or whatever they deem that to be. However, a person who does not know when to stop consuming will always go hungry for more and more. This type of person will always be in want and lack the real treasures of heaven and earth. _______________________________________ apppro’s take for 10/11/2008 @5:30 pm EST: All this CEO bashing just reminds me of this Jack Nicholson tirade. Just substitute him for our CEO’s if you want the truth, but maybe Its just human nature to bash & blame someone when they screw up, but who told them to do it in the first place? Especially in the case of our current housing and financial crisis – yeah, that’s right – it was YOU & ME!!!!!!! Those were your 52” plasma’s, Those were your ridiculous SUV’s, Those were your 3rd vacation of the year to Aruba, Those were your overly expensive homes, Those were all your other totally extravagant and unnecessary fringe items that we all just had to have; and all of this excess was being afforded by the actions of the same CEO’s you are now so quick to judge and condemn. When it comes down to it: “We want them on that wall! We need them on that wall!” There is sure a lot of blame to go around, but just place that blame on the true culprits – narcissistic, Generation Me short sellers. Until they systematically destroyed the confidence in the mortgage market in order to cover their short positions and egos, we had no crisis. In the meantime I wrote to the Governor of New York with another take on my fix:

Dear Governor Patterson, This mess just might be easily fixed, especially for New York State. Maybe you should be screaming at Sec. Paulson to:

Take a small amount of that ‘Rescue plan’ = maybe 30 billion and buy back the CDO’s of the muni bond insurers (Ambac, MBIA) – RIGHT NOW! Recapitalize them as Sec. Dinallo wanted to do 10 months ago. Make sure the ratings agencies then immediately upgrade the ratings to AAA, which they said could happen. Have the FED give an implicit guarantee to ANY NEW insurance policies written on the bonds. Basically guarantee the bond’s triple A, not the policy or the company. Doesn’t cost a nickel. Maybe the Fed could kick in an incentive for any bonds issued for Capital Projects to help with employment and infrastructure. NOW the municipalities can issue bonds and BUILD.. BUILD.. BUILD. Puts people back to work. Pays our bills, etc. We need the bond insurers restored back to normal and we need it now. Solves ALL the issues at little or less costs.

Yours truly, apppro

No one listens. Now all I hear is a Global plan to buy stock (at our expense) in the very financial institutions that refuse to lend any of us any money in the 1st place. _______________________________________ apppro’s take for 10/02/2008 @6:30 pm EST: I am very, very concerned about how all this is going to end and right now it doesn’t look good. Today’s selling was just not the relentless onslaught by shorts, but now also included massive dumping by everyone else just to save capital. I said last year that unless the shorts and negativity stopped, that all this would ‘end very badly’. We’re there! The locust shorts have moved on to the commodities now, and many have lost 50% of their value in 2 weeks. Deplorable! We are self imploding and no one says anything about why and who is causing this. Just blame the CEO’s & Congress – that’s all anyone does. Now we get the ‘it’s the economy—stupid’ argument. So oil has gone down to a less ridiculously high level, that doesn’t mean that companies like Alcoa and Caterpillar are now worth 50% less. Just shorts playing the ‘let’s destroy these stocks now’ card. This morning our old buddy from long ago, Wilbur Ross came on TV and basically agreed that my banks ‘won’t spend the money’ argument was right on. Not for the same or right reasons imo, but he agreed nonetheless. This afternoon a muni bond expert came on and finally someone else but me said that the destruction of the monoline insurers was at the route cause of this entire mess. Little consolation, but I’ll take what I can get. Where we all go from here is anyone’s guess. _______________________________________ apppro’s take for 09/30/2008 @6:30 pm EST: A couple of people asked me what I thought about the ‘Rescue Plan’ and what might happen. OK, why they asked me is a mystery in of itself, but I’ll give it a shot. Firstly, we must agree on why all this happened. Yes, the shorts did it thru their systematic destruction of the CDO/mortgage markets which lead to the downfall of the financials, but now that’s not really the main issue any more. Now we must go back to school and retake Psych. 101. Actually we’ll have to take Advanced Psychology, because what’s happened here is so very complex. It all comes back to confidence and fear. Do you remember the water-boarding blog of the banks? In short, beat someone over the head over and over, and they will break. Once broken, the victim will take a very long time, if ever, to gain back the level of confidence needed to resume normal behavior. The banks were tortured into submission by short sellers and rating agencies over the CDO’s that those Me’er shorts had convinced everyone were worthless, which now have become by some miracle to be just worth less. Give me a break! Everyone now blames the ‘Fat Cat’ CEO’s of the banks for causing all of this, when in reality they deserve the Congressional Medal of Honor for the torture they’ve gone thru for their Company & Country. How can we expect the banks that have been so tortured, abused, punished, and in many cases destroyed to now so willingly say: “Oh, thanks for this money – here, I don’t really need it.. take it.. please!” I wouldn’t! You wouldn’t! Nobody would! When they get this money from the bailout they’ll squirrel it away out of fear that the shorts and ratings agencies will come after them again. And do you blame them? Just Monday, the day of the vote, some anal_ysts were still calling for some big banks to fail. We can fix this, but it will take a comprehensive approach of: 1. Reinstating the Up-tick rule, 2. Cracking down on naked shorting, 3. Instituting some rules on what should be said on National TV, 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. 5. Aid to the banks during the transition back to normality, 6. Refinance the monoline insurers with funds, so that roads can get built.. schools can be funded.. bridges will be repaired.. Etc. 7. Give money to municipalities to build.. build.. build. 8. Hold oil under $100.00 while building a natural gas infrastructure for autos. Drill.. Drill.. Drill. 9. Put back rules and regulations on short selling that have been around since the 1930’s. 10. Eliminate 'mark to market', and 11. Have the rating agencies come up with ONE set of rules and stick to them. 12. Increase the FDIC insurance for banks to give people confidence that their money is safe. 13. Set up a separate fund to lend directly to people and companies with urgent requirements, so things will get bought at the retail level - NOW and not 12 months down the road. 14. Time to heal with some reasonable behavior by market participants during this process. It’s not going to happen overnight. Just to name a few. We need to feed the need and stop the bleeding. Just to place a tourniquet on the leg doesn’t prevent the gangrene from setting in. Unfortunately there are still far too many jerks out there that are betting on us all loosing our shirts.

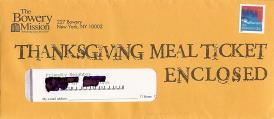

Oh, and #15 – STOP BLAMING THE DAMN CEO’S!! THEY DESERVE A MEDAL FOR DEALING WITH THIS BULL!%?!. This wasn’t their fault! _______________________________________ apppro’s take for 09/30/2008 @6:30 am EST: We have no one to blame but ourselves. The 777 point loss yesterday was just a portal to the real truth. Pull the lever and you take your chances. (I apologize for this, but it was just too much of a coincidence to ignore.) _______________________________________ apppro’s take for 09/29/2008 @5:30 pm EST: I guess I’m going to have to open and use this letter this year!

Not funny! A disgrace plain and simple, and I don’t mean not passing that stupid rescue bill, either. The true disgrace is that we are still letting those Me’ers get away with all of this. _______________________________________ apppro’s take for 09/28/2008 @8:30 am EST: The bailout plan is 1 step closer to passing. BFD! Here’s my take: it’ll be a big bust and will not benefit anyone – not even the banks that are supposed to be the main beneficiary. Why do you ask? It’s because it really doesn’t address the main culprit: shorts. I know you’ve had enough of that, but don’t shoot the messenger. Even if the markets open up tomorrow, by Tuesday (if not by late Monday) it’ll turn into a big bust. Obviously the bad mortgages that started all of this are now not so bad after all. All we have accomplished was to transfer all that wealth from the big banks, brokerage houses, investment banks, you, me.. Etc., to a few short sellers. The banks that own all of that now ‘non-toxic’ debt are still fighting for financial survival. The shorts are still, albeit with a slight respite because of the ban, gangshorting the financials thru the XLF (among others) and massive ‘put’ buying. Really nothing much has changed. The banks are scared !%?!less over loosing their credit ratings via Moody’s’, etc totally arbitrary Ouija boards. The banks will NOT loan out any of that money, but just squirrel it away in fear. Main-street screwed gain! In the meantime, the shorts are just going to resume ‘rumor-boarding’ the banks with the same old arguments, emphasizing the: “How are they going to make money?” argument. As soon as the bs short ban is lifted, if not sooner, everything will fall apart, and we’ll all look at each other with stares of disbelief. Well, believe me, until we address the shorts and make them accountable for this mess, keep staring – nothing good will come out of any of this. Sorry! The Golden Rules 1. Reinstating the Up-tick rule 2. Cracking down on naked shorting 3. Instituting some rules on what should be said on National TV 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. _______________________________________ apppro’s take for 09/26/2008 @8:30 am EST: I wasn’t planning on making any more posts about all this bailout crap – just totally fed up with everything and everyone. Then I saw the following Yahoo chat room post on the Sirius board and couldn’t hold back:

Just deplorable! It’s like this person is sitting in front of his computer.. pushing buttons.. and just totally giddy about the destruction of our society and financial system. What ever happened to moral responsibility and compassion for others?? Everything I’ve blogged about over the past 2 years has come to pass, except for 1 thing. From the uptick rule to now people realizing it was a loss in confidence, I had this nailed - unfortunately. Believe me, I’m not happy about any of it. I’ve been screaming in an empty room, and the last thing I’ve been screaming at the top of my lungs about is the role the shorts have had in all of this. NO ONE STILL SEES IT AND LISTENS! They blame it on CEO’s and laws dating back to 1999. Unadulterated bull!%?!!!!!!!!!!!!!!!!!! #4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. _______________________________________ apppro’s take for 09/23/2008 @5:30 pm EST: "Well, here's another nice mess you've gotten me into." I finally heard them say something on CNBC that I’ve been screaming about for over a year now: “Exactly where are all those bad mortgages and foreclosures?” And what was confirmed for me is that there just ISN’T as much of a foreclosure catastrophe as the Me’ers have wanted everyone to believe. I guess this is just being confirmed over and over again each time another so-called expert says the U.S. Treasury just might make a profit from this “Bailout Plan”. History will show that these foreclosures were not as systemic as everyone was lead to believe, and they were mainly speculators and people who shouldn’t have been allowed to buy in the 1st place. My heart and prayers go out to those people who got screwed over looking for their piece of the pie. For better or for worse not everyone can have pie, most can only afford a Twinkie. No matter which side of the table you’re on, it is still a crime that we have had to do this bailout just to appease those Me’ers; and quell the insecurity and lack of confidence in our markets that they caused for their own narcissistic greed. I keep (Continued on page 83) |