|

The Stock Room page 53

|

|

(Continued from page 52) 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________ apppro’s take for 01/03/2011 @ 07:00 am EST: All weekend and now all morning long, all I hear is that there is going to be a fight over this in Washington or a fight over that in Washington, BUT never do I hear about a middle of the road compromise and accomplishments anywhere! It’s bad enough that Wall St. allows an all or nothing type of short-term mentality between traders/traitors, why the heck do we have a bunch of myopic idiots doing the same in Washington? Grow up morons! Fighting over pissing rights is not why you were sent to Washington to get $250,000 salaries! Get the so-called people’s work done! Hey, how about our politicians getting paid on performance and not just getting elected? Too bad that they can’t be paid in stock! But then again they would only be paying a 15% tax rate and would be screwing us all over again! _______________________________________ apppro’s take for 01/01/2011 @ 10:00 am EST: Happy New Year everyone! I started to write another one of my tirades about Pimco and how their disgraceful destruction of EVERYONE’S future through their manipulation of the World’s bond market was still not being addressed. Of sure, a class action suit got them a slap on the wrist yesterday Pimco to Pay $92 Million to Settle Lawsuit Over Treasury Futures Contracts - Bloomberg but that was as much of deterrent as taking away Bill Gross’s 3:09 PM Pimco will pay $92M to settle a $600M class-action lawsuit accusing it of illegally squeezing the T-note futures market by not liquidating its longs in the June 05 contract even though it already owned the underlying. Shorts were left scrambling to cover, which shot prices higher. Someone really needs to take care of these people and that deplorable company, but the real issue still remains: NO ONE is dealing with ending the ‘Trader/Traitor Decade’! Even Morningstar seems to say enough is enough! The Year in Volatility - Yahoo! Finance This quote from the very 1st line sums it up for me: “In contrast to 2009 in which many market fears were realized, 2010 marked a year when implied volatility reflected concerns that largely weren't realized.”

When are we all going to understand the true cause of our collective misery over the past 4 years? When are we all going to take some definitive action against the short-term traders/traitors that are gambling away OUR collective future for their own narcissistic profits? _______________________________________ apppro’s take for 12/31/2010 @ 10:00 am EST: With the New Year approaching, I would like to make just 1 wish: Please everyone – stop all this insane short-term thinking and trading! We must all finally put an end to the ‘Trader/Traitor Decade’! I am not the only one seeking to end this insanity. Some of the worst traders/traitors are now even calling for some examination on all this volatility and insane swings. But then we get these OLD drunks with their moronic poetry calling for more insanity and not less. Everyone PLEASE: STOP THE INSANITY NOW! _______________________________________ apppro’s take for 12/11/2010 @ 09:00 am EST: “He Taxes Me!”

This all reminds me of that scene from the “Wrath of Kahn” where Kahn utters the line to the question on why he just doesn’t retreat, “He tasks me!” This entire tax debate… well that “Taxes Me!” instead! Why the heck our entire Nation needs to constantly be compromising on one lousy compromise after another, and NOT just coming up with the best solution for everyone is beyond me. OK, I’m no tax accountant or tax lawyer, and I may not totally understand every in and out of the tax laws, but I do realize that we are way too in debt as a Nation to subsidize everything for everyone and many of us are just not paying our fair share. I want what is fair too, but unless we ask the very rich to help a little more and everyone else to stop getting government subsidies a whole lot less… well if we don’t then we’re all going to be in deep dodo. I realize that the following may not be that eloquent or precise, but you’ll get the point. Here’s a reminder of a few of my ideas: · Leave the Bush cuts as is for everyone UNDER $1,000,000. Come on – you earn over 1 mil you can afford a little more. As you all know my view of ‘trickle down economics’ is more like ‘piss all over everyone else’ economics. · The most critical of all is the need to get the BIG earners to pay their fair share. As Warren Buffett keeps complaining, many out there are not paying their fair proportion, because they get paid in stocks or similar items that are based on capital gains taxes. THIS IS NOT RIGHT! Many will say that this is how business is built! Don’t care! There is no way that anyone can justify Steve Jobs paying ˝ the regular tax rate because he receives only $1.00 in income BUT gets paid $20,000,000 in stock! GIVE ME A BREAK! Let’s say that 50% of that stock income be taxable at regular rates and the rest at regular capital gains. Fair? · All the proposed tax holidays are a good idea to help stimulate things, but not for 2 years – we can’t afford it! · We really need to cutback on all the government subsidies. I understand ANOTHER extension of unemployment benefits is part of the deal. I truly feel sorry for all these people, but enough is enough! 13 months more… we just can’t afford it! How about 6 months and then THAT’S IT—NO MORE! · I find the inheritance tax obscene because it is just a tax on tax. We need to figure something out. Besides, when we leave it up to the millionaires to give it away – they seem to only come up with stupid ideas that do NOT promote prosperity within OUR OWN borders. Leave it is for now, but have a directive that an entirely new policy MUST be set. We must also do as I have been screaming for years now to: STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years - 5% tax on capital gains 2. Capital gains 2 > 5 years - 15% tax on capital gain 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund.

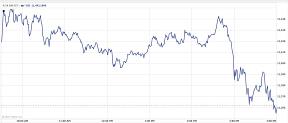

The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________ apppro’s take for 12/07/2010 @ 05:00 pm EST: I really don’t care what was the underlying supposed reason behind the ridiculous selloff today just before 3:00 pm… “It’s The Mentality Stupid” and until we rid ourselves of this trader/traitor mentality and the minute-by-minute fluctuations it causes… well nothing the Prez, Congress, Fed, whoever does will fix our mess! STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years - 5% tax on capital gains 2. Capital gains 2 > 5 years - 15% tax on capital gain 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund.

The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________ apppro’s take for 12/07/2010 @ 09:00 am EST: Who’s The Twit Now? StockTwits® - Share Investing Ideas and Learn from Professional Investors CNBC's Fast Money: Tweet The Street w/ Joe Terranova - CNBC Who’s the Twit now? I think we all are for allowing this to happen. Free speech (Assange?) gone wild! I’m just waiting for a ‘gang Tweet’ that will make the Flash Crash look like child's play! __________________________________________________ apppro’s take for 12/04/2010 @ 08:00 am EST: The Armageddon Fund

After all this time, after all the discussions, and even after all the ridiculous new laws that have been passed… even after all this, everyone still misses the main point of the crisis: That it wasn’t so much that some people missed some of their mortgage payments or that some homes had become way overvalued or that some banks may have come up with insane mortgage scenarios or even that everyone over-leveraged themselves up the ying-yang, NO it wasn’t these or any of the other myriad of excuses given; BUT rather that there was a select group of people betting that all this was going to fail AND no matter what – that in the end, right or wrong, they would convince everyone that IT WOULD FAIL! Things & people just don’t fail that easily or that quickly! Someone has to want it to fail, someone has to be there to help push it off the cliff; and when people are actively coming up with schemes (remember Paulson’s Abacus scheme) to bring it all down – well eventually that persecuted entity will take that leap! Warranted or NOT! Oh sure, that entity may have failed on its own in time, but it was that forced push which exacerbates and hastens the entire situation making the final outcome far more catastrophic! It’s just human nature! Now I think we have the most deplorable scheme of them all and this has been formulated by the most deplorable person and fund of them all – Mohammed El-Erian & Pimco, respectively.

I find this just unbelievable. In order for this to succeed, these new strategies need EVERYTHING TO COME CRASHING DOWN! This just isn’t hedging a bet so to speak, these guys are betting on ways to FORCE that demise. You can say what you want, but Lehman’s would have never collapsed from a run on the bank causing a worldwide upheaval, if it weren’t for a (Continued on page 54) |