|

The Stock Room page 54

|

|

(Continued from page 53) group of individuals pounding the stock over and over and over until it reached its breaking point. Now these guys want the ENTIRE WORLD to come crashing down and are coming up with schemes in order for that to happen! ARE THEY FIRGGEN’ KIDDING? This time when Mohammed of Pimco leads us all up the mountain, he’ll be throwing the entire civilized world off the top! Instead of tying up money in elaborate schemes hell bent on destruction, why not put all that wasted capital into building a bridge or giving someone a job building that bridge? Instead of Mistress Elizabeth Warren going after our banks that had nothing to do with this mess, why the heck doesn’t she go after the scum that keeps coming up with this insanity? Instead of betting on The Eve of Destruction, maybe we should be investing on prosperity and growth!

Golden Rule #4 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund!

Question: If this scenario does come true and the entire world’s economy crashes and everyone & everything everywhere is thrown into chaos – who is left to actually pay off those bets? Rhetorical question! _______________________________________ apppro’s take for 12/02/2010 @ 02:00 pm EST:

Warren Recruits Dodd-Frank Enforcers From 50 States (Correct) - Bloomberg

_______________________________________ apppro’s take for 12/01/2010 @ 05:00 pm EST: Yesterday I asked Andy Greenberg of Forbes (he seems to have access) to see if he could find out the stock positions of Julian Assange the head idiot of WikiLeaks. Check comments at the end of Exclusive: WikiLeaks Will Unveil Major Bank Scandal - Andy Greenberg - The Firewall - Forbes# <<And as 1 final question: Now that this jerk has entered into the world of market manipulation… Do we get to know what his short positions are and which banks he is betting against in order to determine the INSIDER TRADING INFORMATION??? Fine, some trading profits are really not what the real issue is here – why shouldn’t the rest of us know Assange’s TRADING SECRETS TOO?>> <<Andy, just in case you don’t know where I’m coming from… NO matter what he may tell you, the rest of us will never know who else he might be telling or trading with or giving insider information to? Just like the recent raids on some hedge fund advisors – the FBI and SEC or foreign entity should be shutting this guy down and going through his emails, etc. to see exactly what CRIMINAL ACTIVITIES he has been party to.>> <<Fair point. I’ll ask.>> As of the time of this blog, I haven’t heard anything! Have you heard anything? Has anyone heard anything as to which stocks this man is shorting and whom he has been providing insider information to? Anyone? Hey, and check it out to the left… after 3 1/2 years the DOW just broke even. The S&P is still down a little and the Nasdaq is still down big time; but I’ll take what I can get in this insane market. _______________________________________ apppro’s take for 12/01/2010 @ 09:00 am EST: You all know that 1st thing yesterday I started sending out emails about Wikipiss, so there’s no real need to rehash that. As I posted on Forbes last night: <<Maybe Interpol or better yet the Arabs will solve this problem for the rest of us in a timelier manner. Interpol Issues ‘Red Notice’ for Arrest of WikiLeaks’ Julian Assange | Threat Level | Wired.com >> We can only pray for this, and in the meantime you can check some of my other posts on Forbes by clicking the link to the left. With that noted, what happened yesterday all around was really the true disgrace. How we all reacted to this horrid man and his disgusting behavior is more important than anything he may be exposing. In general, most of the world condemned his actions, called for the immediate removal of the illegally obtained material from the web, called on law enforcement to find this guy and throw his sorry a** in jail, and basically most just called him out on how any of what he was doing served the greater good. Then again, we have some that think what he is doing is the greatest thing since Cheez Whiz. These people are just a bad as Wiki’s owner and don’t think otherwise. To aid in the crime is just as complicit as if you committed the crime yourself. If there were items that this man thought were relevant and needed to be brought to light – there are certainly better ways he could have gone about it instead of dumping it on the internet the way he did. Just a disgrace all the way around! The point I want to make is not what Wiki did! The real issue as I mentioned above, is how poorly some reacted. Some called him a hero, some used his information to hurt others, but the worst are so-called media reporters who have taken whatever this guy says as the gospel and have manipulated that unconfirmed information to get their names in print and further their own personal careers with NO consideration to the consequences. Now that this jerk Assange of WikiLeaks has entered into the world of market manipulation by promising to release damaging bank documents, financial reporters (biggest scum of the earth) have published one bogus article after another trying to garner their 15-minutes through rumorboarding and hysteria prone articles. One so-called reporter on the internet said it was Goldman Sachs! Then one so-called reporter at Forbes said it was Citibank, and then based on a year old interview a little while later another reporter at Forbes said it was Bank of America. All this threw the market into violent swings and short sellers went on a destruction feeding frenzy. No wonder no one wants to invest in this market. Just listen to this Kudlow interview. First he starts off with a CNBS moron reporter who seems to be glorying this WikiPiss guy, and seems to want to justify the destruction done to BoA’s stock price as a ‘good thing’. Sorry Martha, what happened was NOT good by any stretch of the imagination.

The 2nd man in the interview is Dick Bove and has a more sensible approach. Whatever you may feel towards your bank, this kind of media hysteria does NO ONE any good! Follow the money people and you will all come back to short sellers needing to make year-end profits. The media is out of control and soon they may crash us all into a wall in a tunnel while we speed in hysteria to get away. “It’s The Mentality Stupid” and the only way to get rid of it is to get rid of their stimulus:

STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years - 5% tax on capital gains 2. Capital gains 2 > 5 years - 15% tax on capital gain 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund.

The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________ apppro’s take for 11/29/2010 @ 07:00 pm EST:

Why the hell the entire European Continent hasn’t just said ENOUGH and called for an entire elimination of ALL the trading surrounding their Euro and economy is beyond me! Last spring we had a bunch of jerks calling for the total demise of the European Union and their entire currency. Now we’re getting it again.

Gartman: Euro Is About to Unravel - CNBC.com

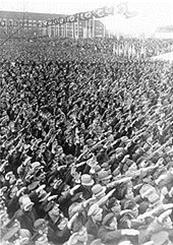

Hey, jerks… this is what World Wars are made of! Are your profits that important? _______________________________________ apppro’s take for 11/29/2010 @ 07:00 am EST:

Believe me I when I say that these 2 episodes can't even remotely be put in the same league, BUT the release and press given to certain financial rumorboarding that I’ve commented on and WikiLeaks’ release of National Security issues:

Are just examples of A MEDIA AND PRESS THAT ARE TOTALLY OUT OF CONTROL! Freedom of the press is a great thing to protect, BUT: Freedom of SECURITY and the TRUTH should be even more important issues to PROTECT! _______________________________________ apppro’s take for 11/28/2010 @ 05:00 pm EST: “Come and Join The CoreUS!”

I have been giving it some thought after looking back over the White House discussion on ‘middle of the roaders’. Maybe we all need a grass roots movement that truly expresses the feeling that I think MOST of us are truly feeling: It’s not a Democrat Left Way or a Republican Right Way that this country needs, but rather a happy medium of the two! I was thinking of launching a website or webpage where people of similar reasonable ideas can come and discuss a rational and compromising approach to ways of solving our Nation’s issues. I thought the following would be a great name: The CoreUS – The CoreUnitedStates and the slogan would be: “Come and Join The CoreUS!” Get it? Any thoughts? _______________________________________ apppro’s take for 11/26/2010 @ 08:00 am EST: Black Friday Specials!

I just made the below comment to another one of those inflammatory articles by a press that is totally clueless to the true reality! Banks are Black Friday's Biggest Losers - TheStreet

“BUT the true losers are the rest of us. Meanwhile, on a Black Friday that appears to have fostered great shopping and confidence, we’re allowing some short-term traders to tank the market because of their need to further create angst over Europe’s supposed ultimate demise. STOP IT!!!!!!!!!!!!!!!!!!!!! _______________________________________ apppro’s take for 11/25/2010 @ 09:00 am EST: Happy Thanksgiving to All!

There’s a great blog going on right now @ the White House Forum for all of you ‘Middle of the Roaders’. Here’s one of my comments. You should check it out to see how others feel! (Continued on page 55) |