|

The Stock Room page 76

|

|

(Continued from page 75) what those short sellers did to Lehman's they are also doing to the rest of us. _______________________________________ apppro’s take for 07/04/2009 @ 09:00 am EST:

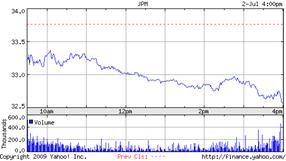

Just look at Thursday’s chart for JPMorgan Chase.

Try to look at the right side where the market 4:00 pm close would be. After a ridiculously low-volume sell-off throughout the day, what you will see is that at 3:59 pm the stock took a further nosedive. This was due to the manipulation of market on close orders, but what you don’t see is that (JPM) closed at a MUCH LOWER level then even the charts could display - $32.27. This after the market close price manipulation is due to shorts playing around with ETF’s tied to the financial sector. It is this kind of shenanigans that will cause the markets’ and our final demise. Boy, I hate to be so pessimistic, but when jerks like are prompted by the media to continually bash everything and everyone – well it gets to you after a while. What really makes me sick is that these (as I call them) 'let it all fails' & ‘new normals’ really seem to find great pleasure and satisfaction by telling everyone that things are bad and will probably get even worse! These pundits never seem to have a solution, but just rather bash thru ridiculous platitudes everyone else’s attempts to correct what a few shorties were allowed to accomplish. This is especially upsetting since the same guys who keep bashing and saying things will get worse, get a direct benefit when things do stay in the toilet. Bonds Will Continue to Outperform - CNBC.com Deplorable! Just deplorable! _______________________________________ apppro’s take for 06/27/2009 @ 09:00 am EST:

I came across this article on Friday about a new documentary that is supposedly exposing the naked short selling of Sirius Satellite Radio. Movie Sheds Light on Sirius Naked Shorts -- Seeking Alpha I own some SIRI and have been following the saga surrounding this stock. In brief, what we have here is a prime example of people’s greed and hubris. The stock manipulation by a few big wigs in order to gain control of SIRI is just so ludicrous and contrived that it borders on true insanity. I really don’t have the energy or desire to get into it, so if you are interested you really should watch the movie. What I wanted to ask is why hasn’t someone done the same for the bigger of the crimes – “The Shorting of America” – thru the entire destruction of our financial system. No reason to go back thru what I have been screaming to myself about over the past 2 years, BUT someone still needs to ask as I did in my 3/25 blog:

2. Who manipulated numbers so to convince everyone that 90% of all mortgages were failing when 92% are still good? 3. Who lobbied the SEC to get rid of the UPTICK rule, and who ran the so-called numbers to prove it was useless? 4. Who naked shorted so many stocks with impunity? 5. Who abused newly formed Ultra ETF's and was able to manipulate stock prices at market closes? (As Jim Cramer has alleged.) 6. How can these same short funds that initiated the destruction of the mortgage CDO’s based on scenarios which claimed that those CDO’s were worthless; now get Government money in order to buy those same CDO’s at bargain basement prices and with little to no risk? 7. Who abused and manipulated our system and made these fortunes, then paid little to no taxes on their outlandish profits? _______________________________________ apppro’s take for 06/21/2009 @ 09:00 am EST:

All I asked for was a short period of calm and sanity. Just couldn’t get it, could I? I’m not looking to make a vast fortune anymore, all I want is to wake up and not find that our Financial World is coming to an end. OK, it was what they call ‘Triple Witching’ this week. Not being an options expert, best way I can explain it is if you try to envision what happens right after a horserace finishes and everyone tries to get his or her money at the pay window. I go back to my “I’m Not Smarter Then a Fifth Grader” blog and pray, no beg, our politicians to bring some clarity and sanity back to our markets. lol Just look at this weekly chart of JPM Chase.

Now our Prez is trying to fix things by suggesting new regulations to our financial markets, and he thinks it will make a difference. Obama: Financial Markets Face 'Substantial Overhaul' - Politics and Government From what I’ve read and heard, all he has done is to add another layer of government employees to monitor segments of the market that are already being monitored by multiple layers of government employees. Just picture the employees of the Post Office being put in charge of supervising the overhaul of the employees of the Post Office! Get the picture! No where in these proposals does he do anything about ‘The Shorting of America’, or even suggest that there needs to be reform with how short sellers brought down our financial system. No where does Obama address the true causes of our problems: Fear & Greed! I still think that the best way to combat this issue is to get people where it hurts – THEIR WALLETS! Take away people’s incentive/profit to do something, and they’ll just stop doing it. Increase the taxes on stock profits, so that long-term investors are rewarded while ‘traders’, short-term investors, and short sellers are penalized; all with the intent of establishing a more sane trading philosophy & atmosphere: Revised Tax Rules: 1. Capital gains under 6 months - 50% tax on capital gains 2. Capital gains under 12 months - 45% tax on capital gains 3. Capital gains under 1 > 2 years - 30% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. I'm tired of paying for the pure shorts 3rd vacation home. _______________________________________ apppro’s take for 06/13/2009 @ 10:00 am EST: The Dow officially went into positive territory for ’09 and has now basically just cancelled out the last 6 months. What a waste of our time and money. Many who could not wait or were forced to sell will never see that money again. Deplorable!

Just deplorable! Also, as I predicted, the same shorts that caused all of this by taking down our banking system have now started to open their own banks with “Other People’s Money”!

Let’s move on. In order to truly declare this mess over, what we really need is to get back to where we were before the shorties took down Lehman Brothers in mid September ’08. Using the DOW as a base, this would be around 11,200. GOOD LUCK on that one! I think the best we could do would be 9500 by years end. But as seeker noted in his last blog, many of the old sins are being revisited. His example of oil speculators is just one. Likewise, rumors and naked shorting are making a come back; and the SEC has done nothing about that either. I am becoming more of the belief, hope, prayer.. that we’ll be very lucky just to stay flat at this level for the foreseeable future. All I (and I think most of the rest of you) want to do is to… wake up in the morning >>> go to work >>> and be able to come home without some pundit somewhere declaring that Armageddon is back. These past 9 months have given birth to one of the most deplorable transfers of wealth in history, and I for one want to make sure that the shorts get neutered and never have a chance of breeding like this again. _______________________________________ seeker’s take for 06/09/2009 @8:00 pm EST: seeker’s website: PointofLife.com

The New Propaganda Induced Oil Bubble by Michael Levy

Sadly, the lessons of the past few years has not taught the financial markets anything other that more of the same. The speculative insanity once again is allowed to get out of control. From a low of $32.00 a barrel a few months ago oil is trading above $70.00 a barrel. Without any signs demand will pickup on a global scale, and supply overflowing, one must assume the speculators still have carte blanche to push the price above $100.00 before the end of the year. China is once again being used by the propaganda merchants. The fact is China will not expand its economy without the USA consumer sucking in 60% of its manufacturing goods. Since this will not happen any time soon, the money they are spending on infrastructure will run dry within six months. An even bigger collapse in the world economies is a distinct possibility if inflation in commodities continues to roar like a lion. The only solution is to halt the speculation in oil prices by bringing in stronger control on who is allowed to trade oil contacts and to restrict anyone who is not directly related to the oil industry from trading futures. The question now is how effective is this administration from the past one at halting the speculative propaganda merchants in their erroneous, greedy tracks. _______________________________________ apppro’s take for 06/09/2009 @ 08:00 am EST: Even the almighty (yeah right) Cramer is declaring that.. Enough is Enough! Guess he must be reading my blog, too! lol Mon. June 8, 2009 6:01pm However, it is truly unfortunate that the Government has decided to enter the auto industry through their end run use of ‘eminent domain’. It is even more unfortunate that a few greedy pensioners’ from Indiana are putting everything on hold by bringing this debacle all the way to the Supreme Court. Supreme Court Asked to Block Chrysler Sale to Fiat - ABC News Come on people – like I’ve had to do with my stocks – take your loss and move on! _______________________________________ apppro’s take for 06/07/2009 @ 09:00 am EST:

Over the past 10 months we have succeeded in allowing a few to wipe out the past 10 years of our collective: Þ Savings, Þ 401K’s, Þ Jobs, Þ The economy in general, Þ Emotional stability, Þ Sex life, Þ Etc., Etc. For many of us the last 10 years of our financial life has turned into one very long, unrealistic dream! Now many are saying there are ‘green shoots’ in the economy and things are turning around. Fantastic, considering we should have never been put into this predicament in the 1st place. So, is it time to move on and get back to living our lives? Wait a minute, what about all those shorties that forced this upon us; have they just totally gone away? I don’t think so! In early March, FASB made changes to those deplorable ‘mark to market’ rules I’ve talked about, and since then the markets have gone up over 40%. Coincidence – no way! Now if we could only get that sorry SEC to put back the blasted ‘uptick’ rule, things just might have a chance. But no, they’re still too busy trying to persecute (thought I was going to say prosecute) various people for PAST discretions. Come on guys >>> look to help the future, the past is the past. This week the SEC said that they're going after Angelo Mozilo, the former CEO of CountryWide Mortgages. Fine, maybe he deserves it, or just maybe as someone on the web said, “Like Al Capone, the only way they could get him was on tax evasion!” Yeah, just like Al Capone, we’re prosecuting these people for just ‘giving the people what they wanted!’ Time to move on, get the shorts OUT OF THE MARKET, and get on with solving the real issues at hand. Instead we are now allowing that same group of shorties to call into question (not that it doesn’t really deserve it) the outlandish spending going on by Washington in name of our salvation. The infamous ‘another shoe to drop!’ Enough already, this isn’t Elmelda Marcos’ closet! “Why can’t we all just get along!”

But this one truly sums it all up! Stewie Griffin Meets Wall Street _______________________________________ apppro’s take for 05/31/2009 @ 05:00 pm EST: I must preface with the comment that I never intended my blogs to be of a political nature and to ever ridicule the President or anyone else for that matter. However, because this administration has decided to become so involved in matters of Wall St., I therefore must make a comment from time to time. This is one of those times.

How hypocritical can people be? The current administration and their various minions (Rep. Barney Frank for one), have bashed companies and banks over and over again for wasting money on trips to various locations. They blasted them so much, that the entire City of Las Vegas, NV was almost forced to close down from Washington bashing! OK, a little bit of an overstatement, but true nonetheless. Now our President saw fit to take an excursion to New York City for what he called, “Date Night.” Is he friggen’ kidding? He bitches about how privately owned companies spend money and then uses taxpayer funds for a totally outlandish jaunt to the Big Apple. And please don’t tell me that somehow they figured out it wasn’t taxpayer funds! BS! While not a fan of their policies either, this quote by the Republican National Committee is truly priceless. "As President Obama prepares to wing into Manhattan's theater district on Air Force One to take in a Broadway show, GM is preparing to file bankruptcy and families across America continue to struggle to pay their bills," the GOP said. "Have a great Saturday evening -- even if you're not jetting off somewhere at taxpayer expense." (Continued on page 77) |