|

The Stock Room page 41 |

|

(Continued from page 40) Yesterday during his 2nd and more ridiculous than the 1st news conference, our Fed Head admitted he had NO FRIGGEN idea on why the recovery has been so slow. Just read my blog and he’d know: But that would be too much to ask. Meanwhile, did any of you catch that truly idiotic way CNBS decided to cover the Chairman’s news fiasco? There were 3 so-called economists turning a button rating the Chairman’s every word. Is this how we want out financial future to be judged like we are on “TMZ”, “Jeopardy”, “Let’s Make a Deal”, or even worse “Wipeout”? What is wrong with these people! What is wrong with all of us? _______________________________________ apppro’s take for 06/18/2011 @09:00 am EST: “Déjà vu all over again!”

I really hate to repeat my comments, but this one from almost 1 full year ago is NOW even MORE appropriate! And again I am being forced to ask, “What have we learned?”

apppro’s take for 07/03/2010 @08:00 am EST: “It’s the Mentality Stupid” I’m sure you all remember the phrase “It’s the Economy Stupid”! It sort of applies now, but so many things have changed we really need to rename that. Yeah, we have a slow and stagnant economy – what the hell do you expect? We yanked / destroyed / eliminated / deleveraged / whatever trillions of $ out of the World’s economy in an extremely short period of time… EXTREMELY short! Then when we went to try and fix it, 50% of our Nation bitched about who caused it, while the other 50% bitched about who was not fixing it! I’ll be the first to acknowledge (read back you’ll see that I’m an equal opportunity complainer) that the Bush administration caused this through a horrid deregulation, laissez-faire agenda, but now the Obama administration is continuing the mess by regulating and bashing everything to death. BOTH ADMINSTRATIONS SUCK! There I said it, can we move on now? What we have is a total failure of confidence & trust. We allowed a few to rumor-board us all to death. Half are screaming that we must spend more, but are spending it the wrong way. The other half are screaming for us to spend less, but seem clueless to what the damage of ‘not getting involved’ would mean. Both sides are just at each other’s throats Our entire Nation has been split in 2 with negativity and uncertainty. Which causes which, is uncertain; but one thing is for sure – neither is necessary! Just stop the short-term mentality all across the spectrum. We ALL just need to step back and take a ‘Time Out’... stop whatever we are doing (FinReg, etc.). We all need to look long-term and stop what I have dubbed ‘The American Idol Syndrome’. Success rarely happens over night! It does for a few, but when most sit back and wait for it to happen, the machines stop working… the society dies!

“It’s the Mentality Stupid!” STOP THE INSANITY NOW! _______________________________________

apppro’s take for 06/17/2011 @ 08:30 am EST:

Greece vs. Lehman’s I wonder just how bad the Greece situation really would be if we had not been forcing them to pay out interest rates of 25% or more on their debt for the past several years? Really people – no one could afford that, and the more we push it the worse it gets. Talk about horrid subprime loans! Where’s Mistress Elizabeth when you really need her? Maybe if we hadn't forced Greece into a “Lehman’s esq” situation like David Einhorn did, then maybe they might be able to get thru this - unlike Lehman’s. Greece, like Lehman’s is being denied reasonable credit in order to short their bonds and Country into further oblivion. Always “Follow The Money”! Yes the similarities are great BUT we obviously learned NOTHING from the blatant naked short-selling and horrid rumorboarding of Lehman’s - maybe we should learn now before it's really too late for all of us. Hey, why not just tell all Greek bond holders that they’ll get paid BUT only on a reasonable interest rate? Why not have the EU and the IMF guarantee those bonds over the FULL term? We don’t need to force everyone into Armageddon just so a few bond holders can get a ridiculous rate of return AND so that a few shorts (Probably the same as the bond holders – get it?) can get a ridiculous profit at others expense. Overly simplified & naive… maybe so, but let’s try anything except what seems to be happening. Kicking that can down the road is not always a bad thing, especially if we kick the can properly and with purpose. Immediate destruction is NOT a good thing for anyone. By punting, we give the person or in this case Nation, the time they need to work things out and to be able to carry that can on their own shoulders. And please, I don’t want to hear—”We’ve tried!” No one has really tried anything, except short-term thinking searching for the elusive and therefore ridiculous ‘end game’! This is life! The ONLY ‘end game’ is death! I for one rather not go there just right now! _______________________________________

apppro’s take for 06/15/2011 @ 08:30 am EST:

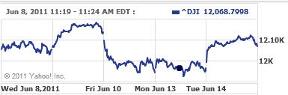

“Karate Kid Market” @ its worst! This is why no one wants to create a new business or hire a new worker or build a new bridge!

Wednesday June 8th – Risk OFF! Thursday June 9th – Risk ON! Friday June 10th – Risk OFF! Monday June 13th – Risk Nowhere! Tuesday June 14th – Risk ON! Wednesday June 15th – Looks like Risk OFF!

When does this insanity stop? STOP THE INSANITY NOW! And get it straight—this insane need to destroy our banks and financial system in order to extort monies to bailout delinquent homeowners who got sucked into the housing bubble, is at the root of the current march back towards Armageddon! _______________________________________

apppro’s take for 06/07/2011 @ 11:30 am EST:

“Quote of the week!” And I paraphrase a bit: “Want to cut the deficit, just get hedge fund managers to pay their fair share of taxes on their outlandish profits!” Not to mention the obvious results of lowering oil prices, stabilizing the currency, forcing speculators out of ‘useless gold’ and into jobs and building, cutting down on financial market’s volatility, raising the living standards on Main St., etc. etc.

STOP THE INSANITY NOW!

_______________________________________

apppro’s take for 06/06/2011 @ 04:30 pm EST:

Dear Mr. President, Today we had another one of those distressing sell-offs in our financial markets. This sell-off was especially highlighted in the banking stocks. All the good that your stimulus may have done and all the good that the Fed’s recent monetary policies may have done and any good that increased business activity also may have done… well all that is being destroyed! While no one should ever stick their heads into the sand, we also cannot ignore the unwarranted destruction when we allow a few to again bring us to the brink of Armageddon. I understand the need by some to punish our banks, though I do not agree with the reasons or the potential outcome. However, to allow a few short sellers and disgruntled homeowners to destroy our banks again will be a total travesty. Please listen to the 2 people in this video from that horrid CNBC. One sees nothing but doom and gloom, and we all need to dig our shelters. The other sees a positive view of growth in the United States, and a healthy banking system goes hand in hand with prosperity… destroying the banks serves NO ONE!

Which of these views do YOU want as your legacy?

Yours truly,

- - - - - - - - - - BTW: It was Weiner’s wiener!

_______________________________________

apppro’s take for 06/02/2011 @ 02:00 pm EST:

“Just Proves My Point!”

This is exactly why we need my ‘Golden Rules’ enacted immediately!

This morning a press release was put out claiming that some ‘BIG’ banks were going to be downgraded by Moody’s. Not that anyone should pay any mind to that joke of a ratings agency, the effect was still devastating. Shorts drooled at the mouth and pounced! The above chart shows what happened to JPM Chase, and it ended up that they weren’t even mentioned in the final slight reevaluations of some banks. This is exactly what happened to stocks just before the final collapse in 2009. Better yet, just stop all this day-trading by large hedge funds and especially SkyNet, and maybe we might have a recovery that will last. STOP THE INSANITY NOW! _______________________________________

apppro’s take for 06/01/2011 @ 09:00 pm EST:

“Cramer’s Supercalifragilisticexpialidocious Market”

Today was just a total disgrace, but what can you expect from this ‘Karate Kid Market’. Yesterday we had risk on… today was a violent and unwarranted risk off! Disgraceful! All this does is cause ‘unreasonable uncertainty’ in people’s minds; and why invest in jobs and businesses when Armageddon Part Deux is only days, or in the hearts of shorts… hours away! I hate to quote the Cramer, but tonight he really pegged it. (Continued on page 42) |