|

The Stock Room page 43 |

|

(Continued from page 42)

More like ‘Crime & Punishment’! The Crime: That we have willingly allowed radicals and our sworn enemies to become the dominant force controlling our collective Armageddon. The Punishment: Throwing Israel, our sworn ally under the proverbial ‘bus’ for questionable reasons and logic. This man does NOT speak for me… maybe Oprah, but NOT ME! I know where I was in 1967, where was Obama – still in diapers? Sir Reverend Wright must be peeing in his pants with glee! Tweet That! I also hope that the below idiot is NOW chastised for his past reporting and comments. This is a perfect place for me to say, “I TOLD YOU SO!” Please pay extra close attention to the end of the video and who is cheering him on in the background. Just a disgrace! TODAY Engel: Middle East 'negative' on Obama's speech _______________________________________

apppro’s take for 05/13/2011 @ 05:30 pm EST:

Hedging vs. Speculation

The amazing1 sent me a link to a video where he wanted me to hear how a CNBS expert saw just how insane the commodity market was! OK, but all I got out of it was this quote that sounds more like gambling – and it is! What a joke! Just a disgrace! Whatever! But what really got me was a totally ridiculous interview with Michael Masters on CNBS – he screamed about the oil speculators back in 2008 and no one listened. Well, he’s trying again If we don’t stop this real soon, any recovery will be short lived and we’ll all (except for those ultra rich hedgies) be waiting for Gadot. Hey Mr. Prez, you got that slime-ball Bin Laden… how about getting these guys, too?

STOP THE INSANITY NOW! _______________________________________

apppro’s take for 05/11/2011 @ 07:30 pm EST:

“Just Totally Out of Control!”

Higher oil prices are bad, because the consumer will drive less & have less money to spend. Lower oil prices are bad, because they show that the consumer is driving less & spending less money! When some say that people were selling today, well… DON’T BELIEVE IT! Investors weren’t selling – shorts were shorting – BIG DIFFERENCE. Listen to a true investor (even though she’s a regular on that horror program) when asked, “Did you do any selling today?” So, what happened? Cramer thinks people were selling because they had to due to the collapse in commodities. Understanding the 'Moronic Mechanics' of the Market

So what caused today’s insanity? You know the answer… don’t you? STOP THE INSANITY NOW! _______________________________________

apppro’s take for 05/11/2011 @ 012:30 pm EST:

“Do I Have To Say Anything Else?”

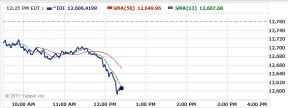

Right now is a perfect example on why we need to stop these traders/traitors and get back to investing. Anyone watching the markets? Tanking 170 points!

And Why? Well, because oil finally is way down again, and those very traders/traitors & speculators that drove it up are now driving it down. WHY? Well as the amazing1 just emailed me, “So they can make money, too!” Yeah great… meanwhile the rest of us get screwed again! STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years* - 5% tax on capital gains 2. Capital gains 2 > 5 years* - 15% tax on capital gain 3. Capital gains 1 > 2 years* - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund. *Anyone whose main source of ‘income’ (retired persons excluded) that comes directly from capital gains, should be taxed at never less than the 1>2 year 35% rate—no matter what the cg term length. The 5 Golden Rules 1. Immediately, reinstate the Up-Tick Rule. 2. Crack down on naked short selling. Require stock certificate #'s when a short sale needs to be covered, including ETF’s. 3. Institute some rules on how the media ’reports’ news in order to prevent rumor-boarding. Not censorship… just sensibility & responsibility. 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund! 5. Have ALL ETF’s trade on a 20-minute delayed basis. Get these instruments of mass destruction back to what they were supposed to do: mimic mutual funds. _______________________________________

apppro’s take for 05/10/2011 @ 08:00 am EST:

“It’s About Damn Time!”

Hey, I would have preferred to tax all those darn traders/traitors directly and collect some much needed revenue for our deficit; but I’ll take anything that promotes stability & sanity. They did this to silver a week ago and look what happened there! That should have been a wakeup call to everyone who thought that our markets had NOT been commandeered by speculators. NOW we need to get ‘useless gold’ back under $1,000.00! _______________________________________

apppro’s take for 05/09/2011 @ 07:30 am EST:

“We Never Learn!”

Monday morning insanity or in this case stupidity: Oil Gold Silver

Therefore job creation, building investment, and everyone else’s standard of living:

Remember that:

_______________________________________

apppro’s take for 05/07/2011 @ 08:00 am EST:

“Even $85 billion can’t buy you respect!”

All I got out of this interview was:

à That this man is HIGHLY respected by the investment community. à He sees no viable reasons for most of the commodities move up – especially ‘useless gold’ and silver. I got the complete impression he was blaming short-term speculators, but he never said it in those exact terms. Þ MOST IMPORTANTLY: Moe and Larry from CNBS showed him little respect and their condescending tone was in my opinion a true disgrace. One can only imagine how many bridges could be built and how many jobs could be created if we just took a fraction of the $56+ BILLION that is being speculated in paper ‘useless gold’ through the GLD ETF! This waste puts anything being done in Washington to shame! It does sort of give me hope, though! I’m not worth anything close to $85 bil, and NO ONE LISTENS TO ME, EITHER! It is true when they say that, “Great minds do think alike!” _______________________________________

apppro’s take for 05/06/2011 @ 08:00 am EST:

“POP Goes the Weasel’s Bubbles!”

Please don’t get this wrong, either. All that we have been doing over the past decade is going from one hedgie created bubble to another! As bad as bubbles are on the way up… as bad as the damage done to almost everyone else by bubble creation – Main St. gas prices, Main St. cost of food, etc. – as BAD as these are, what can be far worse is when the same traders/traitors that created the bubble decide it’s time to go “POP goes the weasel’s bubbles!” In order to max out the profits, the hedgies create far more fear & angst on the way down then they had on the way up; AND like I said many times back in 2008 – FEAR FAR OUT TRUMPS (and not the Donald) GREED EVERY TIME! People start thinking that everything is about to collapse! Selling is exaggerated – layoffs rebound – Armageddon talk is all the rage! All in all, what happens when bubbles burst is far worse! So, what’s the answer! Some call for tighter controls – couldn’t hurt, but won’t stop bubbles. Some call for tighter margins prices – couldn’t hurt, but traders/traitors will just go somewhere else. One thing is for sure, we really need to pull the plug on SkyNet and its ‘social media’ transmission. Listen to the fear in this voice: STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains 5+ years* - 5% tax on capital gains 2. Capital gains 2 > 5 years* - 15% tax on capital gain 3. Capital gains 1 > 2 years* - 35% tax on capital gains 4. Capital gains 6 > 12 months - 45% tax on capital gains 5. Capital gains under <6 months - 55% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 65% on ALL short sales not directly tied to a long buy by a regulated hedge fund. *Anyone whose main source of ‘income’ (retired persons excluded) that comes directly from capital gains, should be taxed at never less than the 1>2 year 35% rate—no matter what the cg term length. The 5 Golden Rules (Continued on page 44) |

![Description: C:\Users\APP Silver\AppData\Local\Microsoft\Windows\Temporary Internet Files\Content.IE5\2D83CXYM\MC900431508[1].png](image21421.png)