|

The Stock Room page 71

|

|

(Continued from page 70) their pay and/or bonuses to look at this video:

I live in New York and I’m not thrilled at all about these budget shortfalls or the fact that NY is NOT getting their fair share of tax revenues, because many banks are not paying out those very bonuses that all you common people are screaming about. Hey everyone, shut up >> pay these guys whatever they want >> then TAX the crap out of them. _______________________________________

apppro’s take for 12/16/2009 @7:00 am EST:

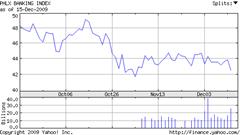

narrator has a free preview on Amazon. Check it out! This has become all too relevant AGAIN, because our financial system is again under attack from naked short traders/traitors, and no up-tick rule just exasperates the 15% decline in 1-month.

_______________________________________ apppro’s take for 12/12/2009 @9:00 am EST:

Has anyone bothered to watch this distorted view on the last 10 years: While the title is right and the concept is right, the causes and reasoning behind it are just so wrong. CNBS loves to promote itself through hysteria and hype; this video is another example of just how clueless they are. The correct title should have been: ‘Trader/Traitor Decade’. It’s obvious what causes these bubbles >> too many people seeking to increase their short-term wealth through the buying and selling of too few resources and/or other financial contraptions that they really have no idea about. The only real difference between the last decade and the thousands of year’s prior is that NOW far more people can try their hands at this because of the speed and ease of the computer/broadband Internet. Sometimes technology is not our friend. The one thing David Faber in that CNBS video is right about is the volume and frequency of bubbles over the past decade. What he totally doesn’t address is the ‘short-term’ mentality that is at the basis of these bubbles and the short-term option trader/traitors that exasperates them. Now, this ‘Trader/Traitor Nation’ just sits in front of their computer screens.. pushing buttons.. creating nothing.. but in the meantime they are destroying everything else. This all reminds me of this great 1983 movie: BUT in reality it has become more like this view: How to Make Easy Money - wikiHow “How do you make money without any skills, and without significant planning or preparation?” Until we stop all this short-term option trading we’re all going to go through these bubbles over and over and over again, and all the while 99% of us are going to keep getting (well for lack of a better term) >> SCREWED OVER! STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains under <6 months - 55% tax on capital gains 2. Capital gains 6 > 12 months - 45% tax on capital gains 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. _______________________________________

apppro’s take for 12/03/2009 @7:00 pm EST:

Got to give that blowhard Cramer some credit every now and then… tonight especially! I guess he’s been reading my blog, because he really nailed the media negativity promotion by shorts this very evening! Yeah I know he’s an ass, but tonight please listen! I just have 2 questions for Mr. Brightass: 1. Where the heck have you been for the past 2 years? Exactly when did you have this epiphany? 2. Why the heck didn’t you direct this comment exactly where it belongs? Right in the face of your fellow so-called reporters on CNBS… the shorts’ main cohorts behind ‘The Shorting of America’. _______________________________________

apppro’s take for 11/21/2009 @5:00 pm EST:

I seem to have generated a good deal of resentment over on some ‘Seeking Alpha’ boards. Everyone really needs to step back and see just how myopic we have become in our views about Wall St. vs. Main St. These are NOT 2 mutually exclusive abstract entities. They should and need to coexist in harmony, or our Nation and society cannot survive. In the past we may have not been able to see the connection, but the stupidity behind Lehman’s takedown saw an end to that. Face it, capitalism is a fragile concept, and it doesn’t take much to destroy it. We all need to realize that capitalism’s main mantra is that a person is going to live up to the deal he has agreed/contracted/promised to do. It is all a matter of confidence and trust, and when that chain is broken – well the entire system collapses. We had a taste of that just 1 year ago. Tina said it best in Mad Max, "Bust a deal... face the wheel!" (I tried to find that link, but I love this one too.) At the root of all of this is the constant minute-by-minute trading & mentality that has emerged over the past decade, and in the end it is going to kill us all. To say it adds liquidity or “it’s the market we have” are NOT justifications, but rather just rationalizations for very poor social behaviors. If long-term investing is dead, then we desperately need someone to bring it back to life before it’s too late for all of us. ______________________________________

apppro’s take for 11/12/2009 @3:00 pm EST: You listen to these 2 guys and all they want you to think is what such altruistic, philanthropists they are, with ONLY the greater good of us all at heart. Yeah and I have a bridge in Brooklyn to sell you, also. And what really should make all of you vomit is how those CNBS jerks just lap it all up, and just can’t seem to wait to kiss their you know what’s! Let’s sing the famous short sellers theme song: “No... no... no... it ain’t me babe! It ain’t me you’re looking for… babe!” They should rename that video segment from “Lessons From the Crisis” to “How to Get Screwed Over - AGAIN!” _______________________________________

narrator’s take for 11/11/2009 @8:00 am EST: narrator’s website: stockshockmovie.com

Goldman Sachs’ secret software and naked short selling <<I am not sure how it happened, whether it was lobbied for years or what -- but along came the biggest mistake of all with the elimination of the uptick rule in July of 2007. This rule had been implemented after the great depression, and had been in place since 1938. How could the Securities and Exchange Commission, or SEC, abolish a rule that had been in place for close to 70 years, and had worked?>> ______________________________________ apppro’s take for 10/31/2009 @9:00 am EST:

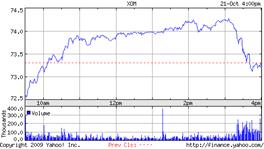

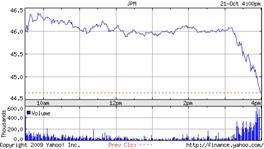

Let’s look at the past week’s chart of JPM Chase.

Monday and Tuesday were ok and non-events on no news. On Wednesday the entire market sold off at the open and never recovered. The news again was really a non-event, but some media pundits & traders/traitors brought back that ‘double deep’ crappola and fear spread throughout. Thursday reality set back in when GREAT GDP and just ok employment #’s came out, but those traders/traitors couldn’t let it go. CNBS had a parade of naysayer pundits on the show Friday morning and when basically so-so spending and income numbers came out at 8:30 am (These numbers were exactly as expected and should have been a non-event.) the short-term option traders/traitors had worked everybody up into a sell-off mode and things never looked back. 250 points down on the DOW and major levels breached. It was a pure disgrace. They tried to blame it on the dollar, on the consumer, on anything they could grab a hold of; but when it comes down to it, the sell-off was a well orchestrated, end-of-the-month options traders/traitors manipulated disaster. Remember the .VIX? I told you a long time ago that this was a measure of ‘fear’ in the markets. Fear is erroneous – GREED of the short-term traders/traitors that make bigger profits when the .VIX increases is more like it. The .VIX JUMPED 25% yesterday – unheard of!

You may ask, “Why should I care? I’m not in the market or I own mutual funds, why should this matter to me?” It matters because you may be one of those lucky people who still has a job, or one of those still trying to find one... all these swings and angst are not healthy. They make everyone so full of fear and uncertainty that no one can muster up the desire to spend, invest, invent, inspire, etc. And don’t make the mistake of thinking that CEO’s of big companies are any different. I told you before, you keep bashing someone over the head over and over; sooner or later they will break! This is especially true of small businesses, the major driver of employment in the U.S. Would YOU spend thousands or go into debt to start a new business if every 5-minutes someone else is telling you that everything will crash in the next 10-minutes? I don’t think so! Whether you’re a Republican or Democratic, whether you’re a capitalist or socialist, whether you’re a ying or a yang; we MUST ALL start to agree upon ONE THING and that is this short-term mentality and trading MUST END! STOP THE INSANITY NOW! Revised Tax Rules: 1. Capital gains under <6 months - 55% tax on capital gains 2. Capital gains 6 > 12 months - 45% tax on capital gains 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. I'm tired of paying for the pure shorts 3rd vacation home. _______________________________________ apppro’s take for 10/27/2009 @7:00 pm EST:

SEC Chair Mary Schapiro: Blame us for financial crisis too - Oct. 27, 2009 Yeah great Mary, BUT YOU MISSED THE POINT AGAIN! GEEEEZZZ! _______________________________________

narrator’s take for 10/23/2009 @7:00 am EST: narrator’s website: stockshockmovie.com

Atlantic Free Press The Short-Selling of the American Dream Decimal Place Trading caused the recession of 2008 _______________________________________ apppro’s take for 10/22/2009 @8:00 am EST:

Question: What do all 3 of these charts of 3 very different companies from yesterday have in common?

(Continued on page 72) |