|

The Stock Room page 72

|

|

(Continued from page 71)

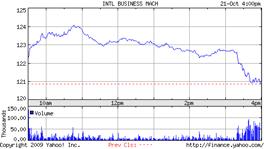

Answer: Nothing and still yet everything! Why would stocks of 3 totally different and diverse companies ALL sell off in exactly the same fashion and in exactly the same way and at exactly the same TIME? Some say it was a bank downgrade of Wells Fargo – who cares! I think it was brought on by this article by ‘The Street.com’ about that hedge fund Galleon being liquidated after the CEO was accused of insider trading. The article was put out at 3:20 pm and the timing of that and the sell-off are so exact that it just seems way too obvious to call it a coincidence. This is the kind of unwarranted hysteria that I keep screaming about. I also have a feeling that SkyNet took control at 03:20:05 pm, and that’s why the reaction was so violent and so widespread. But what really caused it was this quote from the article, “Some of Galleon's traders believe that competing players will short some stocks in a bid to profit as the fund unloads its positions, the Journal said.” When do we call these reporters/hysterics to task? The Internet does have its’ faults and this is a perfect case of unwarranted rumormongering. Hey, isn’t this the EXACT issues that Jim Cramer (the originator, owner, and head of The Street.com) said in the video that I posted below, needed to stop! Practice what you preach.. Jim! _______________________________________

apppro’s take for 10/20/2009 @8:00 pm EST:

Cramer went off on another one of his “get the short sellers” rants tonight. Hey Cramer where have you been? In any event you should all listen because he’s right on with this one. BUT when it comes down to it, all Cramer needs to do is look RIGHT AT HIS OWN CNBS NETWORK FOR THOSE VERY CRIMINALS of whom he speaks! Yeah, like any of those CNBS media pundits would ever admit complicity to ‘The Shorting of America’! Pay very close attention at the date, too! Tues. Jan. 8 2008 | 5:26 PM[03:44] narrator of Stock Shock fame sent me a link to this SEC letter about naked shorting and it’s a must read. _______________________________________ apppro’s take for 10/19/2009 @2:00 pm EST:

Are we all crazy? I screamed about David Einhorn bringing down Lehman’s and no one listened. We all know what happened to our economy in the aftermath. I also have been screaming that he’s been doing the same thing with the U.S. currency while increasing his gold positions. No one seems to believe me on this either. WELL, maybe now that he is saying it himself – MAYBE NOW YOU’LL LISTEN! Einhorn bets on major currency ‘death spiral’ - MarketWatch We all better pay attention this time, because this time when he brings it all down he will be bringing down the United States, and don’t think he’s not! _______________________________________

apppro’s take for 10/16/2009 @6:00 pm EST: narrator of Stock Shock fame sent me this link to the fabulous RollingStone’s article on naked shorting and the demise of our financial system. Take the time to read this one! As for me, I agree with every part of it, I just don’t think they placed the initial blame exactly where it belongs. They also don’t ask the BIG questions that I blogged about on who came up with ‘The Shorting of America’ scheme. The Wall St. scoundrels who caused this, a collection of narcissistic, ‘Generation Me’ short sellers, are not the ones getting blamed. _______________________________________

apppro’s take for 10/15/2009 @6:00 pm EST:

Back in 1999 I used to get yelled at by this very hot chick about all the day trading I was doing. Day trading for the retail investor was in its’ infancy back then, but NOW I would have to scream along with her at what these traders/traitors are doing to our markets and society in general. They make nothing! They create nothing! They utilize moneys for self-absorbed, narcissistic trading with NO regards to the consequences. 10 years ago when I was doing this, just the mere slowness of the Internet restricted the trading. Now, well it’s just so easy to access and just so fast. All in all, these traders/traitors, along with SkyNet have become ‘too fast & too furious’ and need to be STOPPED! This type of trading is gambling, so tax it like gambling! Just listen to the trader being interviewed. And, why do we need these hyper, foreign journalists to come over here and bash our system and society. Just something else to think about. Again I ask, “Is this really what we all want our financial system to be?” _______________________________________

the hand’s take for 10/15/2009 @7:00 am EST: the hand’s website: Steven Hansen

agree with your blog. _______________________________________

apppro’s take for 10/14/2009 @06:00 pm EST:

Dow 10,000!! That’s great! I again say that we had no real reason to have ever been at 6600, but we allowed those shorties to scare us to death so much that what else could we have expected. Wait a minute.. are we out of the woods now? No way and not because of the so-called recession or Armageddon trade, either! Rather, it’s because we still have not done anything about fixing the market ills by instituting at least the: The 4 Golden Rules 1. Reinstate the Up-tick rule 2. Crack down on naked short selling 3. Institute some rules on what should be said on National TV to prevent rumor-mongering 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/09. More importantly, however is SkyNet and this entire trader/traitor mentality that would still exist – uptick rule or not. We MUST stop this minute-by-minute trading and thinking, or all will be lost. Just listen to this video and prepare yourselves to get sick. This influential trader actually said that soon we would have NO investors.. ONLY traders. Is this what we truly want? Deplorable! Just deplorable! _______________________________________

apppro’s take for 10/05/2009 @05:00 pm EST:

We can no longer base any of our market and macro economic predictions on past assumptions. Whether I agree or not with whether this economy is in a recovery mode, that is not what is at issue and hasn’t been for quite a while. What is, is how we have allowed a few to dictate to the many. Spock was right, “The good of the many outweighs the good of the few. Or the one.” When a handful of shorts and option traders/traitors thru their stooge pundits can manipulate fear via the .VIX and abuse Skynet’s speed all for their own agendas, we have no one else to blame but ourselves. From allowing short funds to manipulate our SEC to eliminating the uptick rule, to the same short funds manipulating FASB to get rid of M2M, to the same short funds to manipulate stock prices thru ultra ETF’s.. and so on; we cannot say this economy is in recovery because we have lost our will to be the masters of our own fate. Fear is a far greater emotion then greed and thru spectacular manipulation of that emotion, we are now puppets of those same short funds. You want things to recover, then do what I called for 2 years ago and crack down on the shorts and option traders/traitors that have nothing more then 5-minute hindsight/foresight in their vision. the hand commented below that, “decisions should be based on the truth - not on a spun version to support an agenda.” True, but that is only attainable in a rational and long-term forward-looking society. We are no longer that! And again I call for those pundits to give a damn solution already! First thing Monday morning ‘Dr. Doom’ comes on CNBS and just spews more of his negativity, BUT AGAIN GIVES NO SOLUTIONS! And heavens forbid those chicken ---- reporters would ask a tough question instead of just bobble-heading him in awe! Deplorable! Just deplorable! __________________________________________________

**NEW CONTRIBUTOR** the hand’s take for 10/05/2009 @7:00 am EST: the hand’s website: Steven Hansen

thank god i was not on the list of the seeking alpha authors you attacked today - but i could have been. the majority (but of course not all) have written positive articles. my articles over the last three months have been economically neutral or positive - until two weeks ago. open your eyes. the coincident data is inconsistent now with the leading indicators - and the historical deep recession / strong recovery expectation is being destroyed while we speak. i agree with you that negative news sells better than positive news. but sorry, i see nothing positive economically out there. spinning data to prove a positive or negative premise is immoral. things are what they are. my forte is not giving investing advise. i suspect the market is going to be driven higher despite the negative economic data because people need to invest somewhere. my complaint is the opposite of yours. the stock pumpers never acknowledge negative news, and try to spin anything negative as positive as they can. decisions should be based on the truth - not on a spun version to support an agenda. _______________________________________

apppro’s take for 10/02/2009 @10:00 am EST:

While taking a peek at various Seeking Alpha comments, I came across a listing of the top 10 ‘Most Popular’ articles/blogs. I just had to laugh, or in this case cry! Most Popular1. Ten Reasons for an Imminent Stock Market Crash2. The Next Major Crisis Brewing3. Wall Street Breakfast: Must-Know News4. Friday Outlook: Fear Strikes Back5. Recession Is Over; Depression Has Just Begun6. Tallying the Damage in Solar Stocks and Sifting for Opportunity7. No Chance of a 'V' Recovery8. CIT's Failure Could Threaten Financial Sector's Overall Recovery9. 7 Dividend Stocks Increasing Cash Payouts10. The Return of the Financial DividendsThe vast majority are very NEGATIVE, and the authors just look/want for the end to come. #5 is especially deplorable! Damn it people – STOP IT! What is wrong with all of us anyway? By constantly wanting things to fail—well be very careful what you wish for! What really pisses me off is that these pundits/jerks can only come up with negatives and never, never do they ever give positive solutions or recommendations. I may not be a fan of the current administration or their policies, but damn it man… at least they're trying! We have allowed a few narcissistic short sellers and egotistical scholars/economists to put us in this position, now we need for them to keep their fat mouths shut. I still find it repulsive that a few were so easily able to dictate to the rest of us on how we should live and behave.

Just as a quickie side note, narrator sent me an email on a “Rolling Stone” article comparing that new Michael Moore movie to narrator’s ‘Stock Shock’ movie. Sounds like a really great article and I’m planning on running out to get the paper. And I’m sorry narrator that I really couldn’t post that entire email you sent – just way too much of a blatant promotion for me. I still love you though. :-) (Continued on page 73) |