|

The Stock Room page 74

|

|

(Continued from page 73) far as I would have liked, no guts – no glory, but he did give me some vindication on what I have been saying for quite some time, which is that these ‘new normals’ NEED things to fail in order for their own businesses to profit! I still find it unacceptable that CNBS promotes this kind of hysterical reporting just to get ratings with no consideration or fair disclosure. We all should boycott the network, or better yet boycott the products they advertise. I truly believe that CNBS doesn’t understand the real damage that they have caused to our economy and society over the past 18 months. Deplorable! Just deplorable! _______________________________________ apppro’s take for 08/25/2009 @5:00 pm EST:

Senator Kaufman of Delaware was on CNBS this morning trying to lead the charge to have the SEC get their act together and put into effect some badly needed regulations and/or reform. He seemed to concentrate today more on the newer ‘flash trading’ issues, but he’s been trying to get the ‘uptick’ rule put back in and also to get the SEC to crack down on naked shorting. I even went as far as to write him an email to give my thumbs up. You may want to join the bandwagon: Senator Ted Kaufman — Senator for Delaware

Dear Senator Kaufman, RE: Financial Market reforms I have seen several of your CNBC interviews and have read your articles concerning financial market overhaul, and I APPLAUD your efforts. I am not equal to your prestige, but I have been screaming about this for years now. You may find my blog not only entertaining, but also quite informative on this issue. http://apppro.net/index_files/StockRoom.html Again, I applaud your efforts and hope & pray you get our deplorable SEC to do something! ANYTHING! Yours truly, apppro xxx-xxx-xxxx _______________________________________ apppro’s take for 08/23/2009 @3:00 pm EST:

Another week of craziness! On Monday the market opened and in 5 minutes it was down 200 points, and then basically stayed there all day.

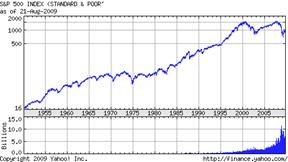

Then for the rest of the week there was a slow, but steady retracement of that loss and then this schizophrenic market tacked on an additional 200 points. All this volatility due to speculative, short-term traders/traitors is very dangerous and needs to be addressed. So where do we go from here? Some say 1200 on the S&P Index.. some say 500. I say why either? What’s wrong with just where we are right now? We’ve taken out all that excess leverage that everyone was screaming about, and that put us back to 11/08 and even 1998 levels. I’m not sure what that accomplished, except for a great deal of pain for so many people; but we’re here now, so I hope all those naysayers and short sellers that put us here are happy!

OK, it’s only 3 more years, but why do we have to go back to 1995.. 500 levels? I keep hearing we’re up 50% from the March ‘09 lows, so now we have to give some of that back in a 20%+ consolidation. WTF? WHY? Just so some traders/traitors who didn’t have the guts to buy in March can get in or so that a few short sellers can rip us off – AGAIN – with more ludicrous profits? Either way they can all go ‘F’ themselves! There everyone finally made me say it.. the ‘F’ word! This economy is trying to get back to some sense of normalcy since Lehman’s was forced into the Underworld by shortie. We scared businesses so much that they laid off people with wild abandonment. Try to look at the big picture: the unemployment rate was barely 4% just 1 year ago, because of all the short inspired fear mongering we got to nearly 10% in 6 short months. That wasn’t a normal increase, but rather irrational fear! Now that the fear has subsided a little (nothing to do with stimulus) businesses are no longer firing and some have even started to bring some people back. We’re healing, let it be! I see no reason why we need to sell this market off at this point just to fulfill some pundits theories on the greater good, or lack there of. Driving this market back down to ‘retest’ the March lows just might give the doomsayers their wish and surely would be the signal of the ‘Final Destination’. I for one know it sure would put a damper on my future enthusiasm! Meanwhile, I see narrator has been at it again. “The FCC delayed the merger of Sirius and XM for 18 months so that would be 6 months prior to Uptick Rule elimination which would be January ‘07. Was the abolishment of the uptick rule established (July ‘07) because of these new technologies merging that would eventual create the new news media years down the road as people use these cell phones to video tape news, link there videos to You Tube and also link their photo’s and taped recordings thru these i-phones that have all this media capabilities. Could this be the main reason why all of a sudden the up-tick rule was abolished and what followed right after that the most shorted stock on Wall Street was Sirius XM Radio.” Now that’s some conspiracy theory, but I have to still strongly suggest as I have stated before, that it was a few short sellers preparing for the elimination of M2M and their planned take down of the monolines. Hey, you want a crazy conspiracy theory, then consider this: The Bush administration was very concerned over the public’s perception of the Iraqi War. >> They thought that by flooding the system with cheap credit and over-leveraged housing, everyone would go out to buy homes, big cars, and plasma TV’s; and not care what was happening in Iraq. >> Banks were given permission for 30 to 1 leverage and subprime loans were born. >> But as early as 2006, when the ’Skull and Bones’ connection saw that they could never win the 2008 elections because of the WAR, they had their contacts at selected hedge funds start to short everything. The ‘Shorting of American’ began.>> Then in July ‘07 the Bush administration got rid of the Uptick Rule and in October ’07 had ‘mark to market’ instituted. >> The hired shorties then rumor-boarded every subprime loan ever made into submission and this caused the demise of the famous CDO’s that underpinned those mortgages. >> All this collapsed the monolines > which collapsed the brokerage houses > which collapsed our banks > which finally collapsed the entire World economy. ALL just for payback over destroying the Bush Legacy and for the possible election of a Democratic President in 2008. (Can’t blame this one on Obama either – everyone thought it would be Hillary back then!) _______________________________________ apppro’s take for 08/17/2009 @2:00 pm EST:

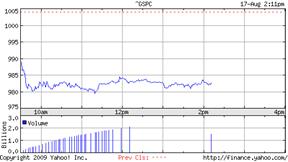

The SEC put out a release today saying that they’re still trying to figure something out about the short sellers and they would like the publics’ comments. SEC Seeks Comment on Alternative Uptick Rule; 2009-185; Aug. 17, 2009 Great, but I’ve searched the site and still see no direct links to where these comments should be made! Typical SEC bs! Damn it SEC.. just do something.. anything!!!!!!!!!!!!!!!!!!!! Read my blog for tons of ways of fixing the casino that Wall St. has become. Just look at today’s 200-point drop in 5 minutes and for no better reason then China farted.

Just do it! _______________________________________ apppro’s take for 08/16/2009 @9:00 am EST: narrator wrote an absolutely fantastic blog on how Goldman Sachs participated in SkyNet’s manipulation of our financial markets. This truly must read article explains in rather understandable terms how traders/traitors have used our technology to make trades that build nothing, invest in nothing, promote nothing, etc., except that is to expand their own commissions and bonuses. As narrator points out, “The Securities and Exchange Commission (SEC) has now promised to ban this technique, and flash trading on the Nasdaq will stop on September 1.” I hope by the word promise he means that our useless SEC WILL do it. I’m sick of their empty promises. Anyone remember their promise to reinstate the ‘uptick rule’? BS! narrator also makes a brief comment on what I’ve been pushing for, “It’s about time the government imposed some taxes to stop the worst of these scams and recover the public some of its money.” Here.. here! I still say that forcing the IRS upon these people is the best way to get them. Hey, that was how we finally got Al Capone, but unlike Capone who was, “Only giving the people what they wanted!” these traders/traitors are in it only for themselves. However, even the IRS won’t get anything accomplished if we don’t change the tax rules to penalize these outlandish salaries, bonuses, commission, or whatever you want to call them. I’m a real capitalist, but I also firmly believe that no one should be paid these amounts for a job that just pushes paper & buttons around, and builds/makes nothing; but if we are going to pay them then we should put in some taxes to help pay for the messes they cause. See some of my recent posts for my tax solutions. _______________________________________ apppro’s take for 08/02/2009 @9:00 am EST:

Here we go again with the Wall St. bogus bonus arguments. Don’t get me wrong; I too think that these salaries/bonuses are obscene, but probably not for the same internal reasons as you. Do I hear jealousy rearing its’ ugly head? However, whatever each of our own demons may be, that’s not what is at issue here. No matter how you view these outlandish, perverted, unwarranted, disgusting, immoral, etc., etc., salaries; the real issue and crime is that these perverts (for lack of a better word) are not paying their fair share of taxes! Most of these incomes, even the almighty Buffett said it, are taxed at rates that are much lower then the rest of us, or just not proportionate to the normal base population. Many of these pervies are paying only a 15% Capital Gains rate, while the rest of us are at the 35%+ income rate. I know as well as the rest of you that our Nation and Constitution are based on fair and equal tax rates, and that no one part of the population should be taxed at a higher or lower level as the rest: "No taxation without representation", but that also goes the other way.. doesn’t it? Whether you agree or not with these salaries and the arguments for them, we can make them work for us. Fine, pay these people whatever the market will bare, BUT tax them accordingly. No one really needs to make a $100 million dollar bonus for trading oil futures, but if they do – TAX THEM at an equally obnoxious rate – let’s say 75%. Also if these guys/gals are getting paid in ways that make their salary capital gains and not income, then we MUST also redo that tax code similar to what I proposed to limit that evil ‘trader mentality’ that has arisen. Revised Tax Rules: 1. Capital gains under <6 months - 55% tax on capital gains 2. Capital gains 6 > 12 months - 45% tax on capital gains 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. I'm tired of paying for the pure shorts 3rd vacation home. Using the IRS also gets rid of those ridiculous arguments about losing talent to another company if you don’t pay your people those salaries. Even if you want to give these arguments any credence, they are NOW negated over the fact that these traders/traitors will have to pay these new tax rates no matter what company they work for, so why leave. If you want to bring up the argument that they will go to another Country to work, well I say, “LET THEM GO AND DON’T LET THEM BACK, EITHER!” Don’t worry; there’ll be a thousand just dying to take their place. _______________________________________ Just a quickie, please refer back to my 6/12/2008 blog on oil speculators. Boy am I good! _______________________________________ apppro’s take for 07/28/2009 @7:00 am EST:

The narrator from Stock Shock fame emailed me yesterday all excited about this news release: SEC rule on 'naked' short-selling now permanent - Yahoo! Finance I’m sorry, but right now all I’ve got to say about what the SEC does is LOL; and that’s a very LOUD ‘LOT’S OF LUCK’ LOL and not a weak ‘laughing out loud’ one. Like our market, the SEC is broken and has totally become irrelevant. Their actions, or lack of them, confirm this. This extension of the naked short-selling rule was put in by our old and also inept Chairperson Cox, and was based on the honor system. It never worked and just extending it is a joke. The bigger issues have now become, as I have blogged, the entire ‘trader mentality’ issue, the ultra short ETF’s, and the ‘flash trading’ that SkyNet has implemented. These 3 issues need to be addressed quickly and the SEC isn’t even considering them. Useless! I am still urging that we hit these traders/traitors where it hurts, in their wallets and tax them up the ying-yang for their abusive trading practices. Hey, at least if it doesn’t stop them we get them to help to pay for the damage.

Side note: I apologize for not updating the quotes, but you can always get 15-minute delayed ones in The Quote Room. _______________________________________ seeker’s take for 07/25/2009 @11:30 am EST: seeker’s website: PointofLife.com Reply post to apppro’s.

Has The Market Run Too Fast, Before It Learnt To Walk By Michael Levy Disclaimer: I am not giving advice, rather, just my layman's point of view.

They say, pride comes before a fall and it would be foolhardy not to take profits on this two week, enormous rally, that I feel has not got the true foundation to go up from here. In fact, it has gone up too far, too fast and for mostly premature reasons. Like it or not, this has become a traders market in the casino of greedy gain. If it continues to rise (and it may well do so) it will only take some nasty news, from out of the blue, to send the stock market crashing 2000 points, back to 6,600 or below. I am neither a bull nor a bear, rather, a student of fear and greed. The greed has overtaken the fear this past week, however, the race has not got near the finish line yet. If you want to find a yardstick for success in the stock market, look around your neighborhood and see how many businesses and people feel prosperous. Those who want to keep their portfolio of stocks can find protection in EFT's such as SDS that shorts the S&P 500 or QID that shots the QQQ. I am not a fan of short selling, however, when a market gets unbalanced on the up side, it has its uses to avoid a disastrous fall in value. There is no doubt, the day will come when it is prudent to buy and hold for future growth, but that may not be for a few year until the housing market, unemployment and collateralized notes have returned to more normal levels. As much I dislike the idea of short selling I have taken a position in SDS on Friday for protection on the few stocks I have left, as I have been selling into this rally ... I may not have to wait too long to close it? I hope I'm wrong for everyone's sake, however, there is no such thing as a bad profit.

From apppro: GEEEZZZZZZZ!!!!!!! _______________________________________ apppro’s take for 07/25/2009 @10:00 am EST: That sure was a nice couple of weeks – this week especially. Even after those horrible Microsoft earnings, the market stayed upbeat. Oh, and those MSFT earnings were their own doing! Idiots, and I own some so I can say so. We’ve gone from Armageddon revisited in June, to happy days are here again (fabulous video). You all know how I feel about it, so you can thank me later. Meanwhile, we still have NOT fixed the problems. No, not bank liquidity, but rather the causes of all this. The 4 Golden Rules: 1. Reinstate the Up-tick rule 2. Crack down on naked short selling 3. Institute some rules on what should be said on National TV to prevent rumor-mongering 4. Pass a Wind-Fall Capital Gains Tax of 65% on ALL short sales retroactive to 01/01/08. At least it appears that some Congressmen have taken up the cause. Maybe these guys can fix what the SEC has totally refused to even acknowledge. (Continued on page 75) |