|

The Stock Room page 73

|

|

(Continued from page 72) But here is one quote by narrator that is really worth sharing: <<funny how CNBC / GE selling out to Comcast. lets see here Sirius XM 18.4 million subscribers and DIRECT TV ( not Comcast ) and yes Comcast has over 24 million subscribers. so #2 Sirius XM + # 3 Direct TV are partners and coming after #1 Comcast 24 million subscribers. Well.. Well.. well, is the picture getting clearer and clearer to CNBC/GE involvement in the news media cover up and attacks towards Sirius XM Radio.>> Note: Corrected on 10/15/09. _______________________________________ apppro’s take for 09/26/2009 @9:00 am EST:

Late Friday afternoon, I heard on CNBC that the Chinese government is ‘investing’ $1,000,000,000 dollars in a U.S. hedge fund – Oaktree Investments. China's sovereign fund to invest $1 billion in L.A. firm THIS IS DEPLORABLE! As you all know, I am one of those that directly attribute most, if not our entire current financial crisis to ‘The Shorting of America’ by these very unregulated hedge funds. NOW we have a foreign government giving this humongous amount of $’s to such a secretive and totally unregulated, behind the doors hedge fund! What would happen if the Chinese wanted to short our defense industry into oblivion like these funds did to our financial system just 1 year ago? Are we to allow anyone the ability thru naked shorting, uncontrolled options and derivatives trading to undermine companies like: Boeing (BA), Raytheon (RTN), General Electric (GE)(we took care of GE all by ourselves), etc. Do I hear NATIONAL SECURITY issues??? Are we all insane to allow this? Just to read: Chinese firms' foreign investments: Sino-Trojan horse | The Economist ______________________________________ apppro’s take for 09/16/2009 @9:00 am EST: Cause vs. Create! Let’s take a brief look back at New Orleans & the Katrina hurricane disaster. What ‘CAUSED’ the disaster? Katrina came on shore as a Category 5 storm, but the initial storm surge did not cause the levies to break or to flood the city. I’m sure it didn’t help the situation, but it wasn’t that. As Katrina moved on shore and over the city, nearby Lake Poncetrain was pummeled by 125+ mph winds & they say over 10 inches of rain per hour. Eventually that did it and the levies couldn’t hold back he waters any more. Bye.. bye New Orleans. So, if you had said the winds and rains of Katrina ‘CAUSED’ the disaster, you would have been right. If Katrina had been slightly weaker, or had hit 50 miles east or west, we may have not had the disaster. Besides from the obvious fact that New Orleans should never have been built there in the 1st place; it was years of poor Federal management and bad levy maintenance that actually ‘CREATED’ the underpinnings for the disaster. HOWEVER, it was the short term rains and winds that ‘CAUSED’ it. If the winds/rains had been less, the levies wouldn't have failed and we wouldn't have had the disaster. The levies had never been maintained or even built for a storm like Katrina. People may have been living under an umbrella of false confidence that all would be maintained, and that confidence was easily destroyed by a storm no one wanted to believe would ever come. Those were the beliefs, assumptions, etc. we had all come to accept and live by. However, the ‘powers to be’ had already decided that Armageddon was required IMMEDIATELY, and all the future plans to fix the levies was just a waste of time. The same goes for our entire financial system & economy as a whole. Years of ill conceived Federal deregulation, increased leverage by banks, decreased savings by everyone, and a greedy consumer who wanted it all and wanted it now… those things actually ‘CREATED’ the underpinnings for the disaster. Those were the beliefs, assumptions, etc. we had all come to accept and live by. BUT, it was the intense abuse of ‘mark to market’ (M2M) by short funds, extensive and uncontrolled rumormongering, no uptick rule, & relentless naked short selling that actually ‘CAUSED’ the disaster. If the short funds hadn't been allowed and promoted by the media to bring everything down so quickly and violently by destroying our confidence, we could have worked things out in a timely manner and prevented all this pain. However, the shorties had already decided that Armageddon was required IMMEDIATELY, and all the future plans to fix the financial system was just a waste of time. While some still are trying to fix a few of the inadequacies of our investing market system, the above has been lost in our desire to place blame on the CEO’s of the nation and to hail the doomsayers and destroyers as heroes. _______________________________________ NEVER FORGET!

apppro’s take for 09/12/2009 @9:00 am EST:

September 10, 2001 9605.51 Never Forget!

September 11, 2008 11,433.71 2 days before Lehman's idiocy.

September 11, 2009 9605.41 Not much progress was there!

March 11, 2009 6930.40 Some want us to go back to this!

Now that makes sense! Deplorable! Just deplorable! _______________________________________ apppro’s take for 09/09/2009 @6:00 pm EST:

It appears that others are now realizing the detriments of all this short-term trading & thinking. I still haven’t heard anything about the option traders/traitors, but at least a few see the greater macro issues that I’ve been screaming about for what they are. In this video clip, the Aspen Institute comments on this plague. I think the title should have read: “Overcoming Short-Terrorism” instead. There are others also trying to do something. I am not a fan, but this ‘trading tax’ suggested by the AFL-CIO is at least a viable alternative. I did find great distress in what the other 2 male guests kept saying and intimating. This was especially true when one brought up David Einhorn and how his destruction of Lehman Bros. was ‘a good thing’! Idiots!

I still like my capital gains tax plan better. Revised Tax Rules: 1. Capital gains under <6 months - 55% tax on capital gains 2. Capital gains 6 > 12 months - 45% tax on capital gains 3. Capital gains 1 > 2 years - 35% tax on capital gains 4. Capital gains 2 > 5 years - 18% tax on capital gains 5. Capital gains 5+ years - 5% tax on capital gains 6. Most critical of all — Institute a capital gains tax of 55% on ALL short sales not directly tied to a long buy by a licensed hedge fund. I'm tired of paying for the pure shorts 3rd vacation home. But no matter what you call it, this myopic snapshot trading will only be cured when we all decide to get to the roots, or in this case weeds. Until then, just tax these short-term gains like gambling wins and it will all come to an end. Even if it doesn’t, the extra tax fees will help pay for the mess. Some other opinions on the subject. Some good.. some bad, but moronic answers like Cramer’s speak for itself.

Side Note: Even though I’m thrilled about all this media coverage, I’ve been screaming about these very issues for months now, so I still have to ask, “Where the heck have all these pundits been?” AND, where is the reporting of the media’s complicity in all of this? Self-examination is a hard thing to muster I guess! _______________________________________ apppro’s take for 09/01/2009 @6:00 pm EST:

I have no financial stake whatsoever in the Stock Shock movie, so when I say that I’m truly impressed by this linked press release sent to me by narrator; then you can be assured it comes from a truly unbiased source. White House Curious About Movie: 'Stock Shock' - MarketWatch <<Richard sent his letter to President Obama. Richard never expected a call back. "I got the phone call on August 19, 2009 from the office of the President of the United States," Richard remembers with pride. "I told them it was great that the SEC and President Obama were taking action to make sweeping changes in the financial world.">> I do agree, for the most part, with everything the movie stands for, and I wish narrator all the success in the World. I just hope that if he does have a meeting with our Prez, he won’t forget to have Obama read my blog. :-)

Side Note: And all of this OPTIONS hype and promotion by the media is going to bring us all down just like the derivatives of Lehman’s & AIG did. Remember that there IS a link between Wall St. & Main St.—let’s not forget that, EVER! Options are very short term gambles. Key word GAMBLE! This must stop; we must get back to investing and not having computers control our destiny thru option traders/traitors. _______________________________________ apppro’s take for 08/30/2009 @8:30 am EST:

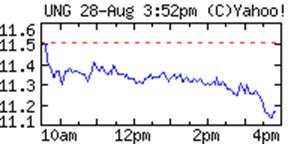

What no one still wants to recognize or even acknowledge is the direct role that the media has played in ‘The Shorting of America’. Over the past 2 years it is easy to come up with example after example of how this has occurred. OK, I have an issue with CNBC, but for better or for worse this cable channel has become one of the biggest culprits in this. Why anyone listens to these individuals is still a mystery, BUT THEY DO and within that lays the problem. What makes matters worse, is that I honestly don’t believe that CNBS sees it. OK, Jim Cramer of Mad Money, who is probably the biggest instigator of all, does occasionally tell his watchers not to buy or sell anything until after the ‘Cramer effect’ has passed; but he’s alone in this. Most, if not all the other reporters just spew out their ‘opinions’ with no fair disclosure or even the slightest consideration for its effects. PLEASE let us all remember that these people have been and are still ONLY REPORTERS. I believe few have any formal financial education and I also believe few, if any, are licensed financial advisors. Their opinions are just that – their opinions – and for them to portray them as the actual NEWS is wrong. Why the SEC and FCC haven’t done something about this is beyond me. Just take a look at this latest example. Natural Gas has been quite volatile as of late and has even approached an all time low. This blog is not about the merits of that, but rather how a 3-minute TV segment can cause investors to lose 2% of their portfolio just because a CNBS reporter decides to air his opinion. Furthermore, this was NOT some kind of news breaking event, but rather months’ old, rehashed information put into a format to promote volatility and hysteria. They even seemed to sandbag one of the guests; another technique that this so-called news program has used lately on a regular basis. On Friday 08/28 at 03:17 pm, Bob Pissani decided to air a segment on commodity ETF’s and used the UNG as his whipping boy. He had on 2 guests, but from the 1st word it was obvious that he had nothing nice to say. Almost the second he started @03:17 pm the UNG price started to tank and within 10 minutes the shorts came in and drove the price down over 1%. I use this because the chart really shows it this time – no one can question the ‘CNBS Effect’. Why hasn’t someone called this kind of so-called reporting into question? In reality it is NOT reporting, but rather just CNBS’s opinions and inflammatory rumorboarding all used to increase ratings. A nationwide boycott of CNBS or even better yet the products advertised would be a great initiative. On a totally different note, I need to once again scream about the proliferation and abuse of all this ‘options’ trading that has been going on. Just as an example, these Yahoo posts on option advice show just how truly widespread & crazy it has become. The Internet and tremendous increases in speed, programming, financial services, etc. has taken this to levels it really was never intended to reach. And please don’t give me the arguments that it adds liquidity or hedges positions: IT’S SHORT-TERM GAMBLING PURE & SIMPLE, AND SHOULD BE TAXED ACCORDINGLY! _______________________________________

narrator’s take for 08/29/2009 @8:00 am EST: narrator’s website: stockshockmovie.com

Decimal Place Trading caused the recession of 2008 by Richard Keane

This recession was caused by the manipulation of stock prices on Wall Street through naked short-selling, flash trading, high-frequency trading, secret software, super-fast computers and what I feel was the main cause of this corruption: “Decimal Place Trading.” As I write this article today, much of this corruption is now slowly coming out through social media outlets such as Twitter and Facebook, along with bloggers on the internet, Yahoo bulletin boards, and the movie Stock Shock. The news media is also to blame for what has taken place in this country -- including the near-collapse of Wall Street and the banking industry. There are many things to point fingers at or place the blame on, and I can think of a few off-hand that I would like to cover -- the first being Wall Street’s regulation changes. I am no expert -- I am not even a writer -- but decided to tell this story since the business news media was not telling it. These Wall Street regulation changes contributed to the aforementioned problems in many ways, with the first being the removal of fractions in stock pricing. On January 29, 2001, the New York Stock Exchange, or NYSE, went to four-decimal-place trading. On March 12, 2001, the National Association of Securities Dealers Automated Quotation, or NASDAQ, followed suit. This new rule had the best of intentions as we headed toward the computer and digital world, but over time it was manipulated and companies like Goldman Sachs figured out how to take advantage of the new system. I am not sure how it happened, whether it was lobbied for years or what -- but along came the biggest mistake of all with the elimination of the uptick rule in July of 2007. This rule had been implemented after the great depression, and had been in place since 1938. How could the Securities and Exchange Commission, or SEC, abolish a rule that had been in place for close to 70 years, and had worked? Put these two changes together, and you get a simple equation: greed plus corruption equals recession. Reports have been released on the web that Goldman Sachs made over 100 million dollars per day in 46 out of 64 trading days in Fiscal Year 2009, second quarter (April, May and June). Let me say that again. They made over 100 million dollars per day, and are still doing it as I write this letter today. But the question remains, how did they do it? There has been no report of this by any of the news media. How can this be? This corruption is 100 times the gravity of the Bernie Madoff story, and yet there has been no coverage by CNBC or Bloomberg News. Why? Goldman Sachs, upon Wall Street transitioning to fractions and the abolishment of the uptick rule, designed secret software and used this software to gain an advantage on every potential investor. Basically, Goldman Sachs became a Las Vegas poker dealer in New York City on Wall Street, turning profits on investors every trade with their super-fast computers and software.

Disclaimer: All blogs are the opinions of the author and do not represent the views and/or opinions of apppro.net. apppro.net takes no responsibility for the blog’s contents or resources. _______________________________________ apppro’s take for 08/26/2009 @6:00 pm EST:

Finally a small bit of vindication. I have been screaming for months now about those ‘new normals’ and their constant calling for a second Armageddon. Today a CNBS guest called it for what it is (or tried to), and said that Pimco and others are just trying to sell their products. Bill Smead didn’t go as (Continued on page 74) |